The global payments landscape is on the verge of a major transformation. Starting November 22, 2025, all cross-border transactions must comply with ISO 20022 standards, replacing outdated SWIFT MT messaging systems. While financial institutions worldwide scramble to meet this deadline, Cardano (ADA) has already achieved compliance, potentially giving it a significant advantage in the evolving digital finance ecosystem.

Cardano and ISO 20022: Why This Matters

The shift to ISO 20022 represents one of the most consequential upgrades in international payment history. According to crypto analyst Mintern, this compliance could provide Cardano with a substantial edge over competitors.

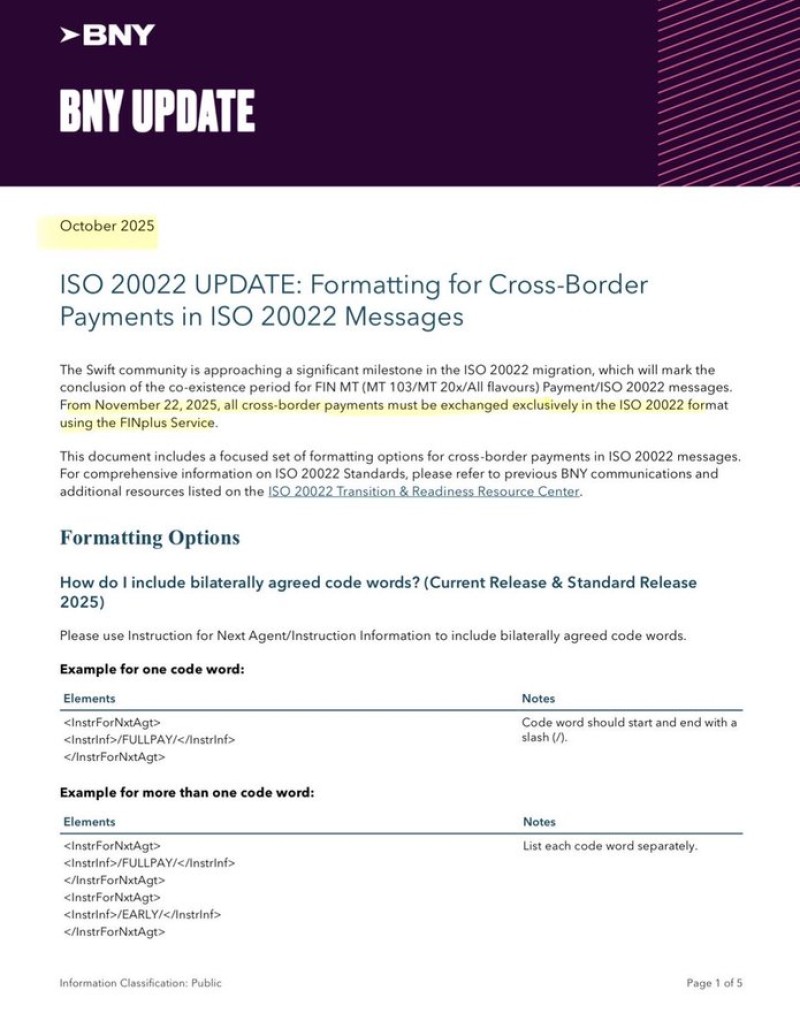

The new standard introduces richer, more structured data formats that enhance efficiency, transparency, and regulatory compliance across borders. BNY's October 2025 documentation confirms that from late November, all cross-border payments must exclusively utilize ISO 20022 formats.

This creates three distinct advantages for Cardano:

- Institutional Integration: Banks can incorporate ADA into existing systems with minimal friction

- Regulatory Positioning: Early compliance establishes Cardano as a blockchain built for regulated use cases

- Adoption Catalyst: With trillions flowing through global payment networks annually, ADA could capture institutional capital

Cardano Price Chart Analysis

Recent price action shows ADA in an extended consolidation with underlying bullish signals. The token has consistently defended the $0.22–$0.25 support zone, demonstrating persistent buying interest. However, the $0.40 level has proven stubborn, rejecting multiple breakout attempts. Accumulation volume has increased visibly as the ISO implementation date approaches. The chart structure displays an ascending pattern that could trigger a rally if ADA breaks above $0.40. Technical projections point toward $0.55 and $0.70 as potential targets in a sustained uptrend.

Could Cardano Bridge Crypto and Traditional Finance?

Cardano's research-focused approach and emphasis on regulatory compliance distinguish it from many blockchain projects. By achieving ISO 20022 standards ahead of competitors, ADA could serve as a critical link between decentralized finance and established banking infrastructure. While this advantage doesn't guarantee market dominance, it places Cardano among a select group of blockchains capable of genuine financial system integration.

Peter Smith

Peter Smith

Peter Smith

Peter Smith