The crypto investment landscape is evolving rapidly, and institutional players are increasingly looking beyond Bitcoin and Ethereum. In a significant development for Cardano, the blockchain project has secured its spot in two major exchange-traded funds managed by 21Shares, signaling growing recognition among traditional finance institutions. This inclusion opens new doors for ADA's exposure to institutional capital and represents a meaningful milestone in the project's journey toward mainstream adoption.

Cardano Gains a Place Among Top Crypto Assets

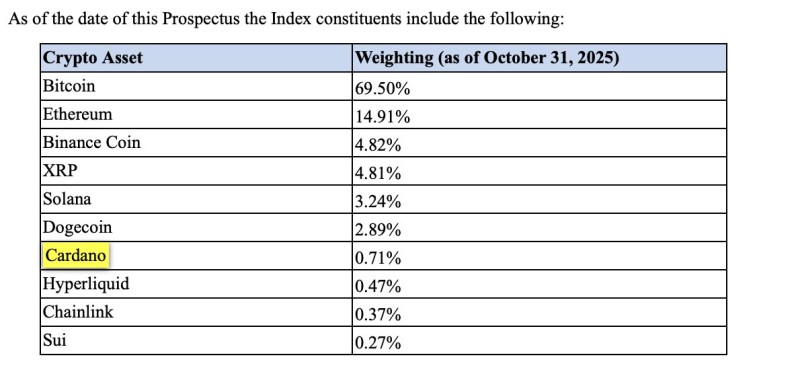

Cardano has officially joined the ranks of elite digital assets by securing inclusion in two key ETFs from 21Shares — the FTSE Crypto 10 Index ETF (TTOP) and the FTSE Crypto 10 ex-BTC Index ETF (TXBC). According to the latest index composition report from October 31, 2025, Cardano now sits alongside a carefully selected group of cryptocurrencies that institutional investors can access through regulated financial products.

The numbers tell an interesting story. Cardano holds a 0.71% weighting in the index, placing it below Dogecoin at 2.89% but ahead of newer players like Hyperliquid (0.47%), Chainlink (0.37%), and Sui (0.27%). Bitcoin and Ethereum still dominate with 69.5% and 14.9% respectively, but Cardano's presence signals that institutions are starting to look beyond just the top two cryptocurrencies.

Why This Inclusion Actually Matters

There are several key reasons why Cardano's ETF inclusion is more than just a headline:

- Easier Access for Traditional Investors: The inclusion gives pension funds, wealth advisors, and institutional trading desks a straightforward way to get Cardano exposure through regular stock markets. They don't need to set up crypto wallets or navigate exchanges — they can simply buy shares of the ETF.

- Legitimacy Boost: Being part of the FTSE Crypto 10 Index means Cardano passed the vetting process used by institutional portfolio managers. This increases visibility among serious investors who track index-based crypto products and adds credibility to the project.

- Part of a Bigger Trend: The updated index composition shows a clear shift happening in crypto investing. While Bitcoin and Ethereum still dominate, there's growing interest in established networks like Cardano, Solana, and XRP that have proven their staying power and continue building active ecosystems.

Market Context and What's Next

The timing of Cardano's addition is worth noting. Institutional interest in diversified crypto exposure has been picking up throughout 2025, driven by renewed confidence in blockchain infrastructure and decentralized finance. ETF inflows across digital assets have accelerated, and investors are actively seeking exposure beyond just Bitcoin.

Cardano's inclusion acknowledges both its consistent network development and the strong community that supports it. While the 0.71% weighting might seem modest, it's actually an important early signal of institutional trust. As these ETFs rebalance over time and investor demand grows, there's real potential for Cardano's share to increase in future updates.

Usman Salis

Usman Salis

Usman Salis

Usman Salis