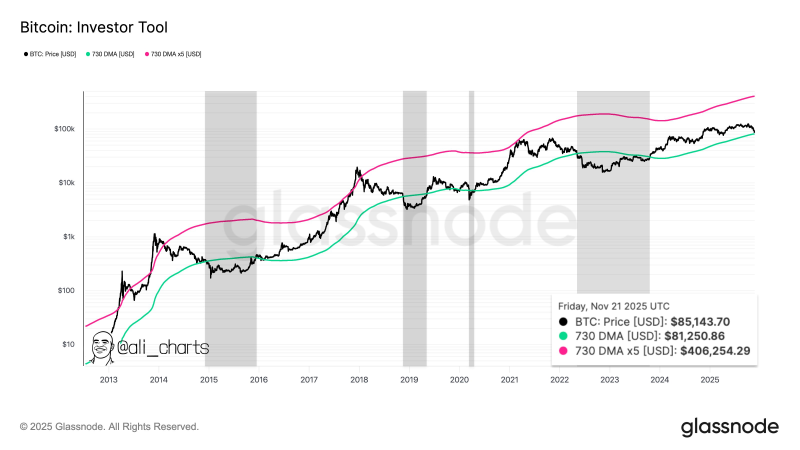

⬤ Bitcoin is hanging out dangerously close to a major long-term support level that's been a game-changer in past market cycles. Right now, the crypto is hovering around $85,143, while the 730-day simple moving average sits at roughly $81,250. This isn't just any random number—historically, when BTC drops below this line, bear markets tend to follow. Market watchers are glued to this zone, trying to figure out if we're looking at a bounce or a breakdown.

⬤ If you pull up the long-term charts, you'll see this pattern play out multiple times before. Every time Bitcoin slipped under that 730-day average, momentum died and downturns kicked in. The shaded areas on the chart tell the story—each one shows where price weakness lined up with losing this multi-year trend line. Interestingly, the upper band (the 730-day average times five) is way up at around $406,254, giving us a broader picture of where this cycle could theoretically top out.

Bitcoin has typically entered bear markets when it falls below its 730-day simple moving average, a trend marker currently positioned near $81,250.

⬤ Despite some rough patches lately, Bitcoin's still above that crucial trend level—barely. The gap's getting tighter though, especially as the broader crypto market has cooled off. BTC is trading well below its recent highs but hasn't broken the 730-day moving average yet. Since mid-2023, long-term price floors have been gradually rising, which is a decent sign. The current setup basically puts us at a fork in the road: hold above this line and we might keep some momentum going; break below and things could get ugly fast.

⬤ Why does this 730-day moving average matter so much? These long-duration indicators tend to capture cyclical strength better than short-term noise. When Bitcoin moves around these thresholds, it usually shapes how traders and investors feel about the market. With BTC closing in on this historically loaded level again, everyone's trying to figure out if we can hold the long-term trend or if we're about to repeat what happened in earlier cycles.

Usman Salis

Usman Salis

Usman Salis

Usman Salis