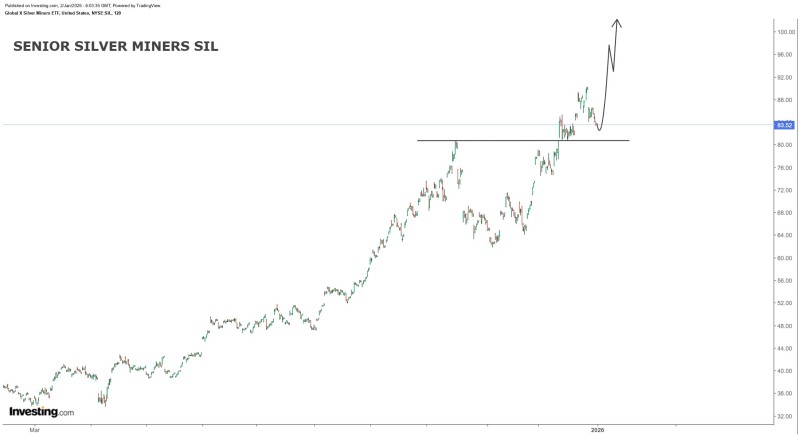

⬤ The Global X Silver Miners ETF has been on a tear through 2025, and right now it's doing something pretty interesting—it's holding steady just above the low-80s, a zone that used to act as resistance. After a strong rally, this kind of sideways action usually means the fund's catching its breath while staying firmly within its longer-term uptrend.

⬤ Sentiment around senior silver miners keeps getting better, especially as traders anticipate more upside in silver itself. What's happening on the chart is classic technical behavior: SIL pushed through that old resistance band, pulled back to test it, and now that level's acting as support. Most analysts see this as healthy consolidation—not a sign the trend's running out of steam.

⬤ Over the past year, SIL has practically doubled, climbing from around $40 to above $80. That's a massive move, and it reflects serious money flowing back into silver-mining stocks. The technical setup points to potential upside around $100 if this momentum holds. With silver itself approaching critical bullish levels, mining equities like SIL could see amplified gains.

⬤ Here's why this matters for the broader market: mining ETFs often move before the actual commodity does, making them early-warning signals for sentiment shifts. If SIL keeps holding above that former resistance and pushes higher, it'll confirm that investors are still betting big on precious metals—likely driven by macro uncertainty and inflation concerns. All eyes are on whether SIL can maintain support here and make that run toward fresh record highs.

Peter Smith

Peter Smith

Peter Smith

Peter Smith