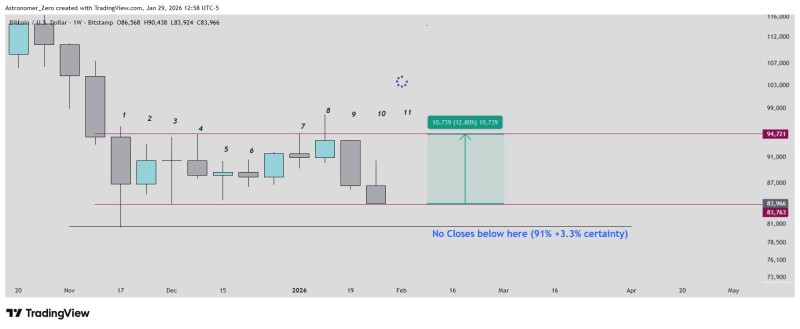

⬤ Bitcoin has spent ten straight weeks consolidating within a well-defined range, with the eleventh week now underway. Despite multiple short-term dips, the high-timeframe bottom structure hasn't been invalidated, keeping the broader outlook positive.

⬤ The weekly chart shows resistance capping price action around $94,700, while support has consistently held above the $83,700-$84,000 zone. Several weekly candles have tested this lower boundary without breaking below it, reinforcing its significance. If support continues to hold, there's potential for a roughly 12.8% bounce back toward resistance.

⬤ The key takeaway is maintaining discipline during choppy price action. While pullbacks of 4-5% have rattled shorter-term traders, they haven't damaged the bigger picture setup. "Discomfort during consolidations is common and often precedes significant directional moves," notes the analysis, emphasizing that patience remains critical as the range continues to hold.

⬤ This matters because Bitcoin's high-timeframe behavior typically sets the tone for the broader crypto market. As long as BTC closes above the low-$80K region on a weekly basis, the constructive structure stays intact. The current consolidation could serve as a launchpad for the next major move once price finally breaks out of this range.

Peter Smith

Peter Smith

Peter Smith

Peter Smith