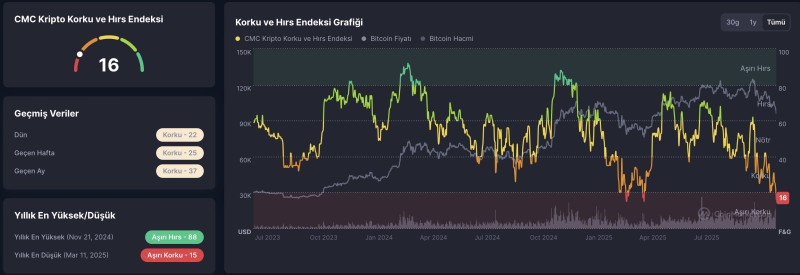

⬤ Bitcoin's Fear and Greed Index has crashed to 16—a sharp drop that puts it firmly back in extreme fear territory. This level is historically significant, often appearing near market bottoms when pessimism peaks. The index has fallen from 22 yesterday, 25 last week, and 37 last month, now sitting just above the yearly low of 15.

⬤ The chart shows how sentiment has tracked alongside BTC's price and volume over the past year. As Bitcoin gradually declined, fear intensified—but extreme readings like this tend to signal exhaustion rather than more downside. When the index drops below 20, it's typically a sign that bearish momentum is running out of steam.

⬤ These deep fear levels have historically preceded rebounds as market stress reaches its peak. With Bitcoin sentiment now at one of its lowest points of the year, traders are watching closely for signs that the mood is shifting. If fear starts to ease and the index climbs back up, it could mark the beginning of a new directional move—making this a key moment to watch for changes in short-term market dynamics.

Peter Smith

Peter Smith

Peter Smith

Peter Smith