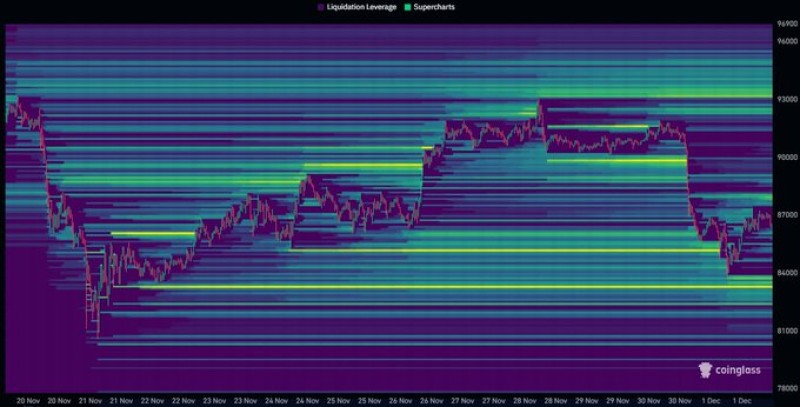

⬤ Bitcoin is finding its footing after Monday's aggressive liquidation sweep, with trading data from Coinglass revealing heavy liquidation clusters stacking up between $83K and $85K. Despite bouncing back from the initial drop, BTC remains vulnerable to these dense liquidity pockets that could pull price action in either direction.

⬤ The liquidation heatmap shows a massive cluster sitting just below current price around $83K—a zone that could act like a magnet if Bitcoin slips below $85K again. There's also a clean price inefficiency left behind near $93K from the monthly open, sitting above the weekend highs and marking one of the chart's most significant liquidity shelves.

⬤ Bitcoin's recent moves highlight how sensitive the market has become to these liquidity-heavy areas. Each sweep through densely packed liquidation layers triggers quick momentum shifts, and the recovery from below $85K shows an active battle between lower support clusters and the untested overhead gap.

⬤ These liquidity zones matter because they often dictate where Bitcoin's next volatile move happens. With $83K acting as a downside magnet and $93K representing an unfilled gap above, market direction will likely depend on which level BTC reaches first—potentially setting the tone for broader crypto market momentum.

Usman Salis

Usman Salis

Usman Salis

Usman Salis