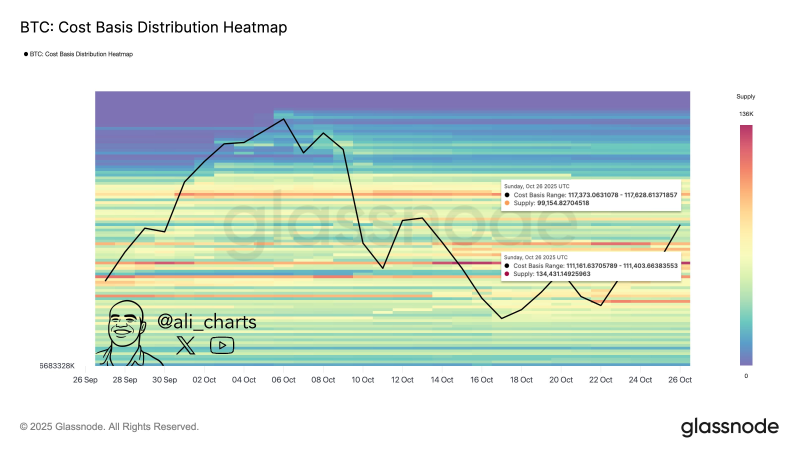

● Bitcoin is currently stuck between two critical price levels. In a recent update, he identified $111,160 as key support and $117,630 as the resistance level Bitcoin needs to crack for continued upside momentum.

● Using Glassnode's Cost Basis Distribution Heatmap, Ali showed that roughly 134,000 BTC were last acquired near the $111K mark, creating a solid support floor. This concentration suggests strong conviction from holders—but if the level breaks, it could trigger quick selling pressure from leveraged positions.

● On the flip side, around 99,000 BTC sit between $117,373 and $117,628, forming a resistance zone where previous buyers may look to take profits. Breaking through this barrier would be a bullish signal and could attract fresh capital into the market.

● These levels tell us something important about trader psychology. Support shows where holders are willing to defend their positions, while resistance marks where others are ready to cash out. Staying above $111K keeps the bullish structure intact, but pushing past $117K could open the path toward $120K and higher.

● With markets still volatile, all eyes are on whether Bitcoin can hold support or break resistance—either way, the next move could set the tone for the rest of the year.

Peter Smith

Peter Smith

Peter Smith

Peter Smith