Bitcoin's price action has entered an intriguing phase where traditional market psychology indicators are painting an unusual picture. While many traders expect the classic capitulation scenario that has preceded major rallies in the past, current data suggests the market might be operating under different dynamics this time around.

Bitcoin (BTC) Price Shows Limited Realized Losses

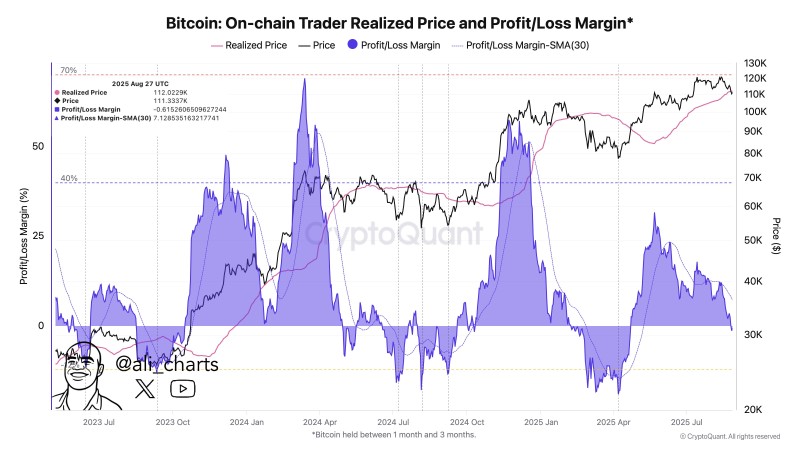

Bitcoin has a well-documented history of explosive recoveries following periods of intense selling pressure, typically when traders' realized losses hit brutal capitulation zones around -12%. Right now, though, we're looking at a completely different scenario. The Profit/Loss Margin sits at a modest -0.60%, which is nowhere near the kind of panic-selling territory that usually precedes major bounces.

Crypto analyst @ali_charts brought attention to this fascinating market dynamic, pointing out how different things look compared to previous cycles. Usually, you'd see deep, painful losses that shake out weak hands before the smart money swoops in. But this time around, Bitcoin seems to be holding up surprisingly well, suggesting that maybe the playbook has changed.

Why On-Chain Loss Data Matters for BTC Price

Here's where things get really interesting from a technical standpoint. The Profit/Loss Margin basically tells us how much pain Bitcoin holders are feeling by comparing the realized price (what people actually paid) to where the market is trading now. As of August 27, 2025, Bitcoin is hovering around $111,333, while the realized price sits at approximately $112,029. That's an incredibly tight spread when you look at historical standards.

In previous bear markets, we've seen realized losses crater into double-digit negative territory, creating those brutal washout events that clear the decks for fresh buying interest. The fact that current losses are so minimal might be telling us something important about how the market has evolved. We could be seeing stronger diamond hands among long-term holders, or maybe the market structure itself has just gotten more mature and less prone to panic.

Outlook: Can BTC Rally Without Capitulation?

This brings us to the million-dollar question that everyone's asking: does Bitcoin actually need that classic capitulation moment to launch its next big run? Traditionally, that -12% realized loss threshold has been like a reliable signal that the worst is over and it's time for the next parabolic move. But Bitcoin's current resilience is making some analysts wonder if we're already past the worst of it.

If Bitcoin can maintain its footing above that crucial $110K–$112K support zone, there's growing optimism that momentum could flip bullish sooner rather than later. Some analysts are already eyeing targets around $120K, which would represent a solid move from current levels.

But here's the catch – without that traditional washout event, we might be in for a different kind of ride. The market could stay choppy and sideways longer than usual as it works through this price discovery process. Traders might need to buckle up for more volatility and patience-testing action before we see a clear directional breakout.

Peter Smith

Peter Smith

Peter Smith

Peter Smith