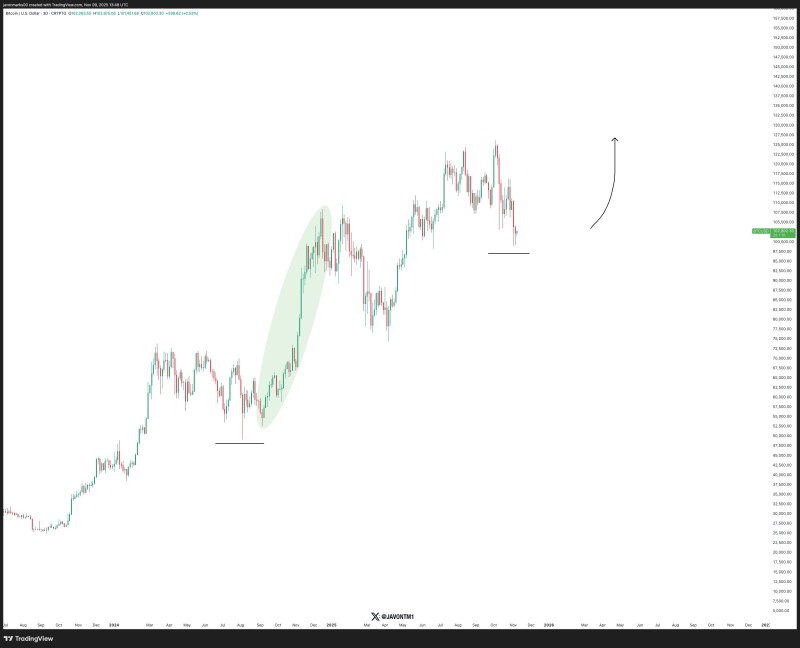

⬤ Bitcoin is showing signs it might be ready for another push higher—and if history repeats, altcoins could be the big winners. The current chart reveals BTC pulling back into a clean support zone that looks strikingly similar to the setup we saw before last year's major breakout. This is all happening as policymakers push forward a new tax proposal targeting high-volume crypto transactions, which could add reporting burdens for smaller firms and potentially drive talent toward friendlier jurisdictions. It's a reminder that technical signals don't exist in a vacuum—regulatory pressure is shaping sentiment too.

⬤ The chart makes the comparison pretty clear: there's a past accumulation zone followed by a powerful rally (shaded in green), and now Bitcoin appears to be forming a similar pattern. It's consolidating near horizontal support in the mid-$100K range, with the structure hinting at a potential rebound. Traders who've been around for a few cycles know these repeating setups often precede big moves—not just for Bitcoin, but for the entire altcoin market, especially when liquidity starts flowing from BTC into riskier assets.

⬤ The idea here is straightforward: if Bitcoin stabilizes and breaks higher, it could pull altcoins along for the ride. That's been the playbook in past cycles—BTC leads, then capital rotates into alternatives as confidence builds. The chart's upward projection captures that thesis visually, suggesting we might be in the early innings of a broader risk-on move across crypto.

⬤ Right now, all eyes are on whether Bitcoin can hold support and kick off the next leg up. If it does, we might see the altcoin dominance phase start to unfold—but traders are also watching how regulatory developments play out, since that could affect liquidity and participation in the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis