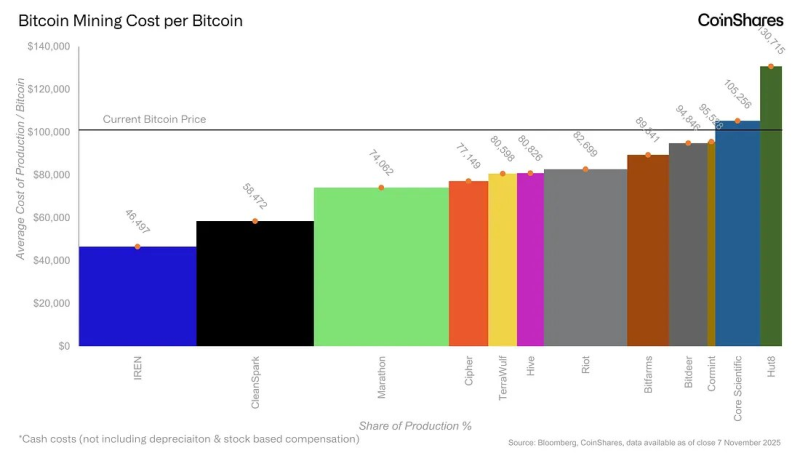

⬤ The expense to mine one Bitcoin has risen sharply. Public miners now pay about seventy five thousand dollars in cash to create a single BTC. When equipment depreciation and stock-based compensation enter the equation, the full production cost nears one hundred thirty eight thousand dollars. Those figures reveal that many mining ventures operate with razor thin margins or at an outright loss.

⬤ The production cost varies widely among large miners. IREN leads in efficiency at roughly forty six thousand five hundred dollars per Bitcoin. CleanSpark follows at about fifty eight thousand five hundred dollars. Marathon stands near seventy four thousand dollars. Cipher sits at seventy one thousand one hundred forty nine dollars. Hive besides TeraWulf both hover around eighty thousand dollars. Riot reaches eighty two thousand six hundred nine dollars. Bitfarms needs about eighty nine thousand four hundred forty one dollars. Bitdeer requires ninety four thousand eight hundred forty six dollars. Core Scientific spends close to one hundred five thousand two hundred thirty six dollars. Hut8 records the highest figure at roughly one hundred thirty thousand seven hundred fifteen dollars. Only a few miners remain under the seventy five thousand dollar cash threshold and mounting operational pressure tightens the squeeze.

⬤ Measured against Bitcoin's current market price, the picture sharpens. Several miners barely cover their cash costs. After long term charges like hardware replacement and equity compensation, the one hundred thirty eight thousand dollar full cost sits far above the comfort zone for most firms. This reality forces the sector to prioritize energy thrift and leaner operations.

⬤ The stakes are high. Mining profit sets the pace at which new hash power joins the network, decides which firms endure or merge and shapes the long term viability of Bitcoin supply. When production expenses narrow margins this much, the competitive map redraws itself. Miners who fail to streamline will falter, a shift that may alter Bitcoin's supply flow and market structure in the months ahead.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi