Bitcoin ETFs recorded $802.5 million in net inflows on Jan. 21, extending a four-day streak as BTC maintains its price above $105,000.

Bitcoin ETFs Record $802.5 Million in Inflows on Jan. 21

According to data from SoSoValue, Bitcoin exchange-traded funds (ETFs) witnessed significant inflows on Jan. 21, totaling $802.5 million. This marked the fourth consecutive day of inflows, with over $3.2 billion added during the streak. Despite minor setbacks, the strong performance underscores the sustained interest in Bitcoin-backed investment products.

Among the 12 Bitcoin ETFs, BlackRock’s IBIT stood out, leading the inflow surge with $661.9 million—the fund’s highest single-day inflow for the third consecutive day. Grayscale’s mini Bitcoin Trust followed, attracting $136.39 million.

Other notable contributors included ARK 21Shares’ ARKB with $8.51 million, Fidelity’s FBTC with $6.97 million, and Franklin Templeton’s EZBC with $6.18 million. In contrast, Bitwise’s BITB saw an outflow of $17.41 million, while several other Bitcoin ETFs recorded zero net flows.

Trading Volume Surges While Total Inflows Near $39 Billion

The 12 Bitcoin ETFs reported a combined trading volume of $5.05 billion on Jan. 21, showcasing robust investor activity. Since their inception, these ETFs have collectively attracted $38.98 billion in net inflows, emphasizing their growing role in institutional crypto investments.

Despite the strong performance on Jan. 21, the inflows fell short of the $1.08 billion recorded on the previous trading day. Analysts attribute this decline to unmet expectations surrounding President Donald Trump’s crypto-related policy announcements.

Trump Administration Sparks Optimism but Delays Action

Market analysts believe President Trump’s inauguration initially fueled optimism in the crypto markets. Kadan Stadelmann, CTO of Komodo Platform, described the early market enthusiasm as a “sell the news” event. He noted that investors had priced in potential policy changes, leading to a temporary slowdown in inflows.

Trump had been expected to issue an executive order establishing a Bitcoin national reserve and prioritizing cryptocurrencies as part of the national agenda. However, his focus on pressing national issues has delayed immediate action on crypto-related policies.

Stadelmann remains optimistic about the administration’s long-term crypto stance, stating:

“Overall, the Bitcoin and crypto markets should still expect a more crypto-friendly administration under Trump. We see institutions still expecting crypto liberalization as they continue to buy up Bitcoin ETFs ahead of expected policy changes.”

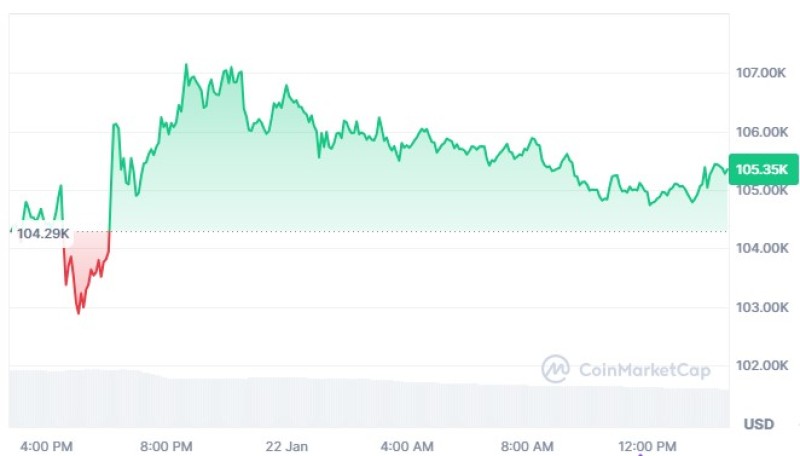

Bitcoin Price Holds Steady Above $105K

At press time, Bitcoin (BTC) was trading at $105,343 per coin, marking a 3% increase over the past 24 hours. This price stability reflects the broader market’s resilience and the growing institutional interest in Bitcoin ETFs.

The Bitcoin market is expected to remain optimistic as investors anticipate further developments from the Trump administration that could favor cryptocurrency adoption and regulation.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah