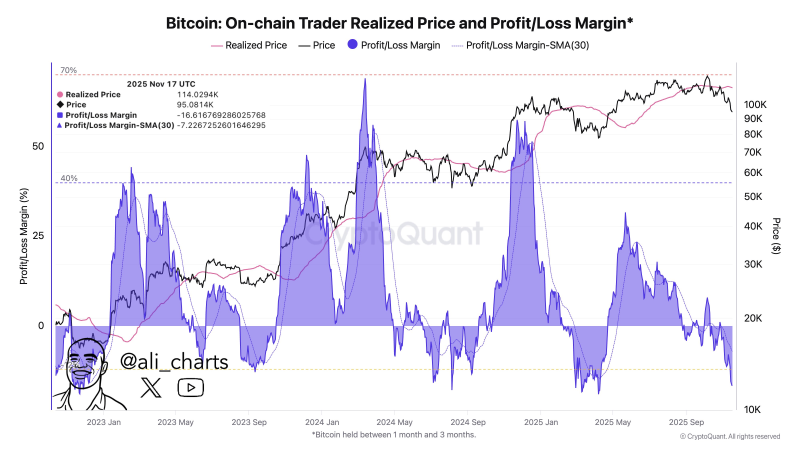

⬤ Fresh on chain figures show that the newest buyers sit on heavy losses. The realised loss margin now stands at about - 16 %, well under the - 12 % line that has marked the start of earlier rebounds. CryptoQuant puts the spot price near $95 081, while the realised price - the average acquisition cost - remains far higher, near $114 029.

⬤ Bitcoin's profit-and-loss margin has fallen into one of its deepest negative readings for months. Earlier cycles show that once losses push under - 12 %, the selling wave often ends and the mood shifts. The present - 16.6 % figure, paired with a 30-day average near - 7.2 %, shows that recent buyers are deep underwater. The gap between the market price plus the average cost base widens quickly, a sign that sentiment has soured at speed.

⬤ Price action confirms the picture. After trading at higher levels earlier in the year, Bitcoin has drifted back into the mid-$90 000 area, even though the average holder paid well above that. The pattern - repeated deep negative readings followed by eventual calm - suggests Bitcoin may be entering a phase in which selling pressure fades once losses become severe enough.

⬤ Why the metric matters - realised loss readings often flag turning points. When margins stay negative for weeks, short term traders tend to run out of coins or patience and price volatility later subsides. The present drop deeper than usual also underlines the market's unease and shows how exposed Bitcoin still is to wider economic moves but also to shifts in liquidity.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi