Bitcoin falls below $68,000 following Mt. Gox's transfer of $3 billion worth of BTC to an unknown address, sparking market reactions.

Historic Transfer by Mt. Gox Shakes Bitcoin Market

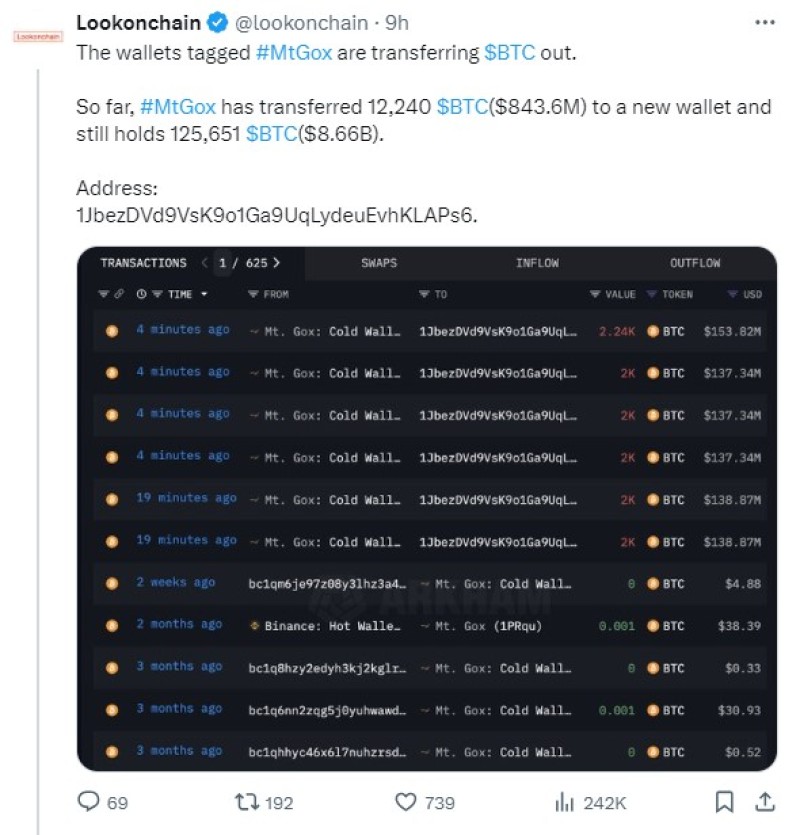

According to Lookonchain analysts, one of the earliest and once-dominant Bitcoin exchanges, Mt. Gox, has transferred billions worth of Bitcoin (BTC) to an external address for the first time in years. This unprecedented move has sent ripples through the crypto market, coinciding with a notable dip in Bitcoin's price.

Mt. Gox, which previously handled over 70% of global Bitcoin transactions, transferred approximately $3 billion in Bitcoin to an unknown address. Blockchain analytics firm Lookonchain reported that over $2.9 billion worth of BTC was moved to the address 1Jbez…LAPs6. The transferred funds have since remained unmoved, raising questions and speculations within the crypto community.

Impact on Bitcoin Price

Following this significant transfer, the wallets associated with Mt. Gox now hold around 137,892 BTC, valued at approximately $9.3 billion according to Arkham Intelligence. The news of this large-scale movement coincided with Bitcoin's price slipping below the $68,000 mark, with the cryptocurrency currently trading at $67,790, as per CoinGecko.

Mt. Gox was founded in 2010 in Japan and quickly rose to prominence as the world's largest Bitcoin exchange. However, its success was short-lived. In early 2014, the Tokyo-based platform abruptly halted trading, shut down its website, and filed for bankruptcy protection, revealing a loss of approximately 850,000 BTC, worth about $450 million at that time. Investigations later uncovered that the majority of these Bitcoins had been stolen over several years from the exchange’s hot wallets, starting as early as late 2011.

Bankruptcy and Creditor Repayments

The bankruptcy proceedings of Mt. Gox have been lengthy and complex. However, there are signs that the resolution is near, with potential payouts to creditors beginning as early as the second half of 2024. Estimates suggest that the total repayments might reach up to $2 billion, offering some relief to those affected by the exchange's downfall.

In conclusion, as the crypto market closely monitors the developments surrounding Mt. Gox's large-scale BTC transfer, investors and analysts are keenly observing the potential impacts on Bitcoin's price and market stability. The historical significance of Mt. Gox's actions continues to influence the crypto landscape, underscoring the exchange's lingering legacy in the Bitcoin ecosystem.

Usman Salis

Usman Salis

Usman Salis

Usman Salis