Bitcoin's price action is coming under scrutiny as recent on-chain data reveals significant selling activity from major holders. The cryptocurrency market often pays close attention to whale movements, as these large-scale transactions can provide insights into potential price direction and market sentiment shifts.

Whales Reduce Exposure in Bitcoin (BTC)

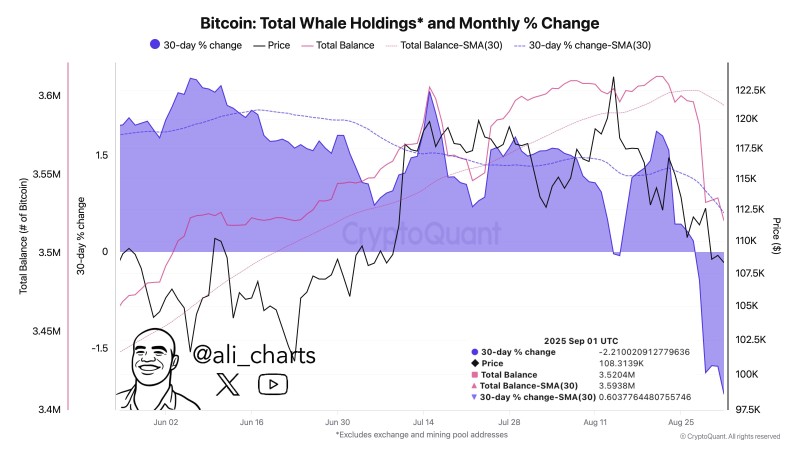

Recent data from @ali_charts reveals that Bitcoin whales have sold about 10,000 BTC over the past week. This major selloff happened while BTC was trading around $108,000. The numbers show whale balances dropped to 3.52 million BTC, with their 30-day holdings down 2.21%.

When big holders start selling like this, it usually gets everyone's attention. These whales can really influence where the market goes next. If regular investors don't step in to buy what they're selling, we could see more downward pressure on Bitcoin's price.

Even with whales selling, Bitcoin is still trading near $108,313 as of September 1, 2025. History shows us that when whales start moving their coins out, we often see short-term price drops. But sometimes they're just moving money around to other investments.

The 30-day average for whale holdings sits at 3.593 million BTC, showing this selling trend has been going on for a while. If they keep selling, Bitcoin might test support levels below $105,000. On the flip side, if whales start buying again, we could see the price stabilize and potentially push toward $115,000.

What It Means for Traders

Traders need to keep a close eye on what whales are doing. This big drop in their holdings shows we could see some sudden price swings, especially if the broader economy weakens or ETF money stops flowing in. But here's the thing - when whales sell and prices dip, it often creates good buying opportunities for long-term investors who want to get Bitcoin at better prices.

Usman Salis

Usman Salis

Usman Salis

Usman Salis