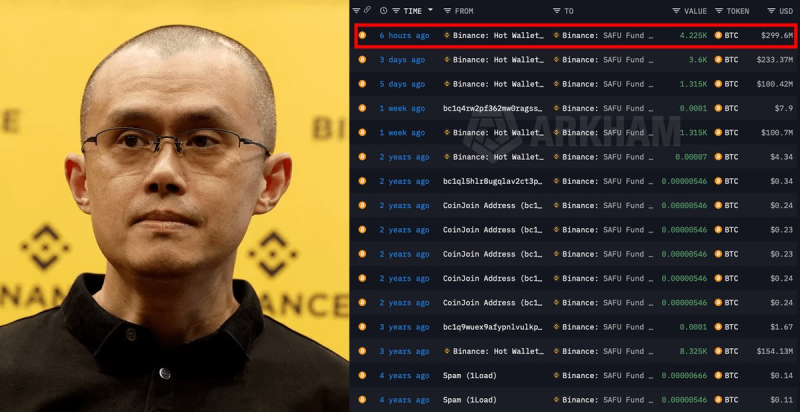

In a significant show of confidence in Bitcoin's long-term value, Binance has made a substantial addition to its holdings with a purchase of 4,225 BTC valued at more than $300 million. This acquisition isn't a standalone move—it's described as the first phase of an ambitious $1 billion Bitcoin buyback program that could reshape how major crypto platforms approach their treasury strategies.

Binance's $300M Bitcoin Purchase Kicks Off Broader Strategy

Binance recently acquired 4,225 BTC in a transaction valued north of $300 million, marking what insiders are calling the opening salvo in a structured accumulation plan. Unlike opportunistic spot buying, this purchase represents a deliberate first step in a $1 billion Bitcoin buyback strategy tied directly to the exchange's balance sheet positioning.

The sheer size of this initial phase—4,225 BTC—signals that Binance is treating Bitcoin accumulation as a serious treasury operation rather than a short-term trading play. By framing this as phase one of a billion-dollar commitment, the exchange is effectively telegraphing continued demand that could influence broader market sentiment around institutional appetite for BTC.

Market Implications and Whale Activity

Analysts are interpreting Binance's buyback as a bullish signal for the wider crypto market, particularly given the exchange's central role in global trading volume. Large-scale platform activity like this often becomes a focal point for sentiment shifts, especially when it coincides with other significant moves tracked across the ecosystem.

Market watchers frequently monitor Binance exchange flows and whale moves on Binance to gauge institutional positioning and potential trend changes. These data points help traders understand whether major players are accumulating or distributing, making Binance's announced $1 billion strategy particularly noteworthy.

As Mr. Crypto Whale put it: When a platform of Binance's scale commits to a billion-dollar Bitcoin buyback, it sends a clear message about where they see long-term value.

Bitcoin Volatility and Platform Positioning

The timing of this buyback comes against a backdrop of ongoing BTC price volatility. Recent market action has included periods of sharp selloffs, making large accumulation strategies all the more significant as indicators of conviction. Related context around BTC volatility and selloff patterns shows why institutional moves like Binance's can quickly become catalysts for renewed attention across the sector.

With BTC remaining sensitive to shifting risk conditions and macro uncertainty, the exchange's structured approach to accumulation adds another important data point to discussions about how major crypto infrastructure players are positioning their balance sheets for the months ahead.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova