Something interesting is happening in traditional finance. Money market funds have swelled to an unprecedented $7.5 trillion. That's a lot of cash sitting on the sidelines, earning minimal returns. The big question is: where will this money go next? Many believe cryptocurrencies, particularly XRP, could be major beneficiaries of this capital rotation.

The Money Market Phenomenon

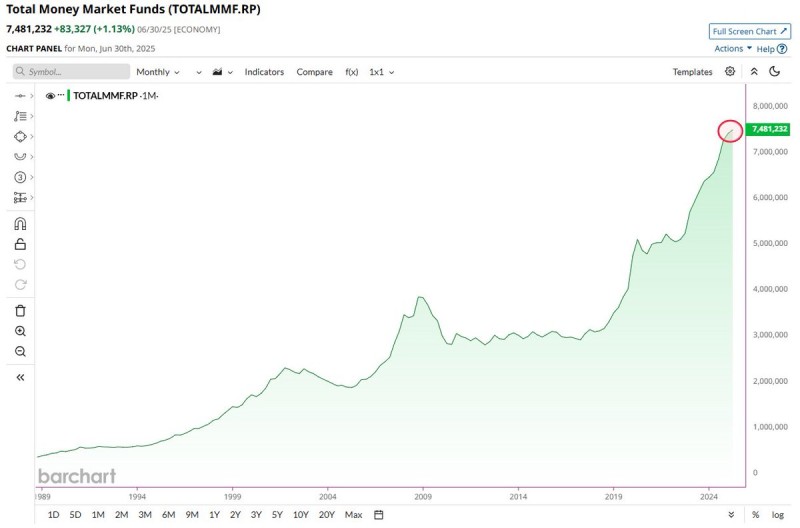

According to recent market data shared by crypto analyst STEPH IS CRYPTO. Money market funds have been climbing steadily since 1989, with dramatic spikes following the 2008 financial crisis and again in recent years. These funds are basically parking spots for cash—safe, stable, but offering pretty low returns. As inflation continues to eat away at purchasing power and investors hunt for better yields, that $7.5 trillion isn't likely to just sit there forever.

The chart tracking total money market funds shows this massive accumulation clearly. While these investments provide peace of mind during uncertain times, they're not exactly exciting when it comes to returns. That's why speculation is growing about where this capital might migrate, and crypto is looking increasingly attractive.

Key factors positioning XRP for potential inflows:

- Institutional credibility – XRP has built real traction in cross-border payments with actual financial institutions using it

- Manageable market cap – Large enough to be credible, small enough for significant growth potential

- Legal clarity improving – Ripple's ongoing legal battles are resolving, making XRP more attractive to traditional investors

- Real-world utility – Unlike many cryptos, XRP solves actual problems in international remittances and institutional payments

- Hedge appeal – In an era of inflation worries, crypto assets like XRP offer an alternative to traditional markets

XRP sits in an interesting sweet spot. It's not as massive as Bitcoin or Ethereum, which means there's more room for growth. But it's also not some obscure altcoin—it has institutional backing, regulatory engagement, and a proven use case in the global payments system.

What Happens If Even a Fraction Moves to Crypto?

Here's where things get interesting. If just 1% of that $7.5 trillion found its way into cryptocurrency, we're talking about $75 billion in fresh capital. That kind of money doesn't just move markets—it reshapes them. XRP, given its institutional appeal and improving regulatory standing, would likely be among the prime beneficiaries.

The timing seems particularly relevant. Traditional investors are becoming more comfortable with digital assets. Institutional frameworks are maturing. And XRP specifically has been working hard to position itself as a bridge between traditional finance and the crypto world.

For those keeping an eye on XRP's price action, a few levels matter. Around $0.70 has been a solid support floor that's held multiple times. The $1.50 to $2.00 range represents a key resistance zone where XRP has struggled before. Breaking cleanly through $2.00 with strong volume could open the door to much higher targets—potentially $5 to $10 if this capital rotation thesis plays out.

But let's be realistic. A sustained move above $2.00 would need real momentum and volume, not just speculation. Watch for increased buying activity and confirmation that institutional money is actually flowing in, not just retail traders hoping for a pump.

Peter Smith

Peter Smith

Peter Smith

Peter Smith