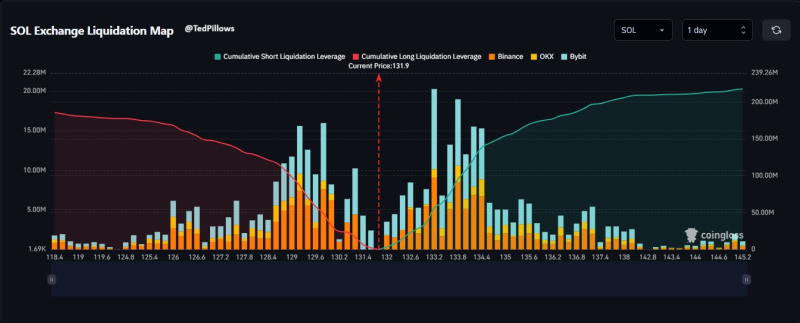

⬤ Solana (SOL) is hovering near $131.9 as fresh derivatives data exposes how price swings could hammer leveraged traders across major exchanges. Data from Coinglass shows that roughly $217,510,000 in short positions are at risk of liquidation if SOL rallies 10% from current levels. On the flip side, about $183,100,000 in long positions would get liquidated if Solana drops 10%.

⬤ The liquidation map breaks down leverage exposure across Binance, OKX, and Bybit, with stacked bars showing liquidation clusters at specific price points. Two cumulative curves track the buildup—one for short liquidation leverage, another for longs. With SOL's current price of $131.9 sitting at the center, liquidation pockets are stacking up both above and below. The heaviest concentration sits between roughly $129 and $135, meaning both bulls and bears have positioned themselves dangerously close to the current market price.

⬤ The cumulative short liquidation curve climbs sharply as prices move higher, showing mounting pressure on bearish positions during rallies. Meanwhile, the long liquidation curve rises as prices drop, exposing vulnerability among bullish traders during selloffs. While the snapshot shows near-balance in overall exposure, short liquidations currently outweigh longs by tens of millions at the 10% threshold.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova