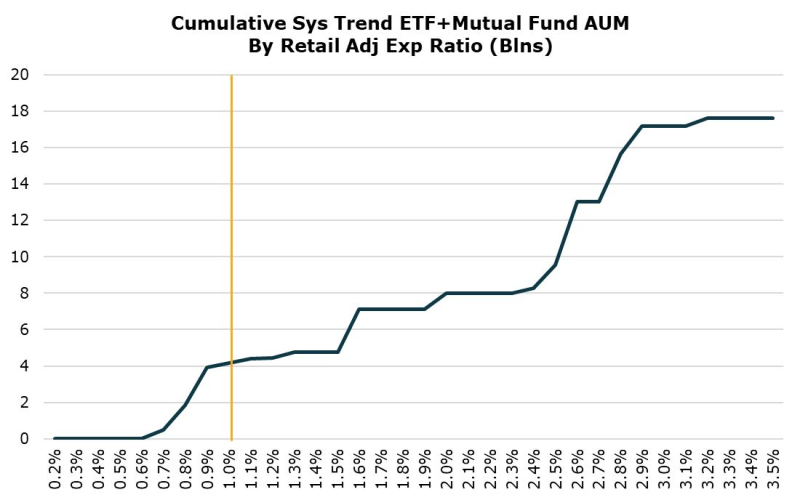

⬤ New figures on systematic trend products show where almost $18 billion sits across funds that charge between 0.2 % and 3.5 %. Managed-futures ETFs cost more than plain index funds - yet they still let retail investors pay far less than they would for mutual funds or for old style limited partnerships that follow the same rules.

⬤ The data tell a clear tale. At a fee of about 1.0 %, the funds together hold roughly $4 billion. Raise the fee to 1.5 % plus the total rises to about $7 billion. Step up to 2.0 % and the tally moves above $10 billion. The sharpest rise occurs between 2.3 % but also 2.8 %; there the figure leaps toward $16 - 18 billion and then levels off.

Managed-futures ETFs still charge retail investors less than comparable mutual funds as well as traditional LP structures.

⬤ The pattern lines up once you look at the price tags - those ETFs do not match the rock bottom cost of a broad index fund - yet they undercut most mutual funds that follow similar rules and they leave the classic 2-and-20 partnership far behind. That gap in price keeps money moving into funds at every listed fee level.

⬤ The lesson is simple - price counts, even in alternative strategies. As more retail investors learn about systematic trend methods, the lower fees inside the ETF wrapper steer where cash flows. With $18 billion already spread across the fee scale, investors want those strategies or they cast their votes with cash after they check the price tag.

Peter Smith

Peter Smith

Peter Smith

Peter Smith