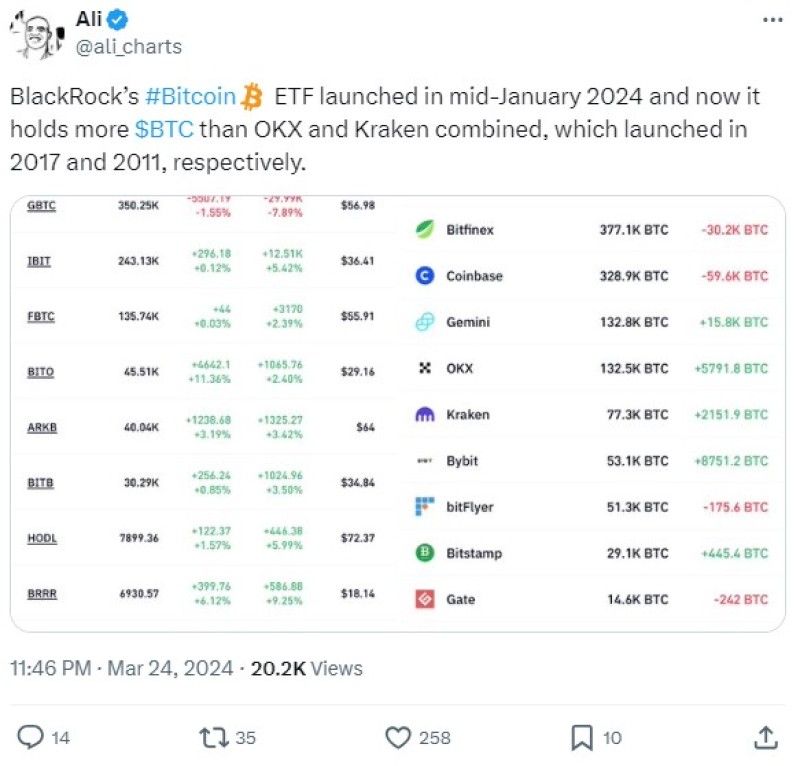

BlackRock's Bitcoin ETF (IBIT) now holds more BTC than OKX and Kraken exchanges combined, marking a significant milestone in institutional investment in Bitcoin.

Rapid Accumulations BlackRock

Since its launch in mid-January 2024, BlackRock's Bitcoin ETF has been rapidly accumulating BTC holdings. This accumulation reflects the increasing demand for cryptocurrency exposure among institutional investors, positioning BlackRock at the forefront of this evolving trend.

Impressive Figures BlackRock

According to crypto analyst Ali, BlackRock's Bitcoin ETF now boasts a staggering 243,130 BTC, surpassing both OKX and Kraken individually, as well as their combined holdings. This milestone highlights the growing dominance of ETFs as a preferred vehicle for institutional Bitcoin investment.

BlackRock's Bitcoin holdings have also exceeded those of MicroStrategy, a notable figure in the cryptocurrency space. With Bitcoin's price showing a 3.47% increase in the last 24 hours, market speculators are eyeing $72,000 as the next potential target, following a sustained break past $66,990.

Market Outlook and Potential Growth

According to Ali's analysis, a sustained breakout beyond $70,400 could propel Bitcoin's price toward $71,800, indicating potential growth opportunities in the cryptocurrency market.

Conclusion

BlackRock's ascent in Bitcoin holdings signals a significant shift in institutional investment patterns, further legitimizing Bitcoin as an attractive asset class for large-scale investors. As institutional interest continues to rise, the cryptocurrency market may see further integration with traditional financial institutions, paving the way for broader adoption and market expansion.

Peter Smith

Peter Smith

Peter Smith

Peter Smith