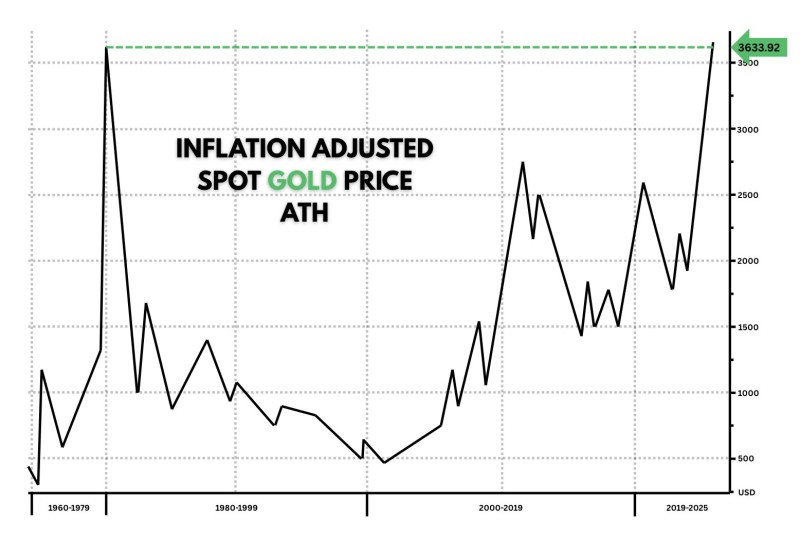

Something big just happened in the gold market that hasn't occurred in nearly 50 years. The inflation-adjusted price of gold smashed through every previous record, hitting $3,633.92. This isn't just another price milestone—it's a signal that investors are fundamentally rethinking their relationship with money itself.

What the Charts Are Screaming

The breakout is dramatic and clear:

- Fresh all-time high: Real gold prices now sit at $3.63k, obliterating decades of resistance

- Massive breakout: After bouncing between $1,000-$2,800 (adjusted) for years, gold exploded higher in 2024-2025

- Steep momentum: The trajectory shows serious acceleration with no historical ceiling in sight

- New support zones: Former highs around $2,600-$2,800 now provide a floor

As Crypto Banter pointed out, this isn't your typical cyclical rally. We're witnessing a structural shift in how the world views store of value assets.

Why Gold Finally Broke Free

Multiple forces converged to create this perfect storm. Falling real interest rates made holding non-yielding gold more attractive, while central banks worldwide continued their aggressive buying spree. Geopolitical chaos from ongoing conflicts and election uncertainty drove safe-haven demand through the roof. Meanwhile, periods of dollar weakness gave gold the breathing room it needed to rally.

From a market structure perspective, gold had been coiled like a spring. With decades of resistance finally cleared, trend followers piled in aggressively. Derivative flows and ETF buying amplified every move higher, creating a feedback loop that pushed prices into uncharted territory.

What This Means for Your Portfolio

The bullish momentum remains intact with no clear ceiling except psychological levels like $3,700 or $3,800. Key support now sits around $3,300-$3,400, and any deeper pullback to the $2,600-$2,800 zone would likely attract aggressive buying. For portfolio construction, gold's breakout reinforces its role as essential insurance against inflation, policy mistakes, and systemic financial risk.

Three main factors could cool gold's momentum. An unexpected economic growth surge could push real interest rates higher, making gold less attractive. Prolonged dollar strength would tighten global liquidity and pressure commodities. Finally, if central banks pause their gold buying programs, it would remove a key pillar of demand.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah