The precious metals market is experiencing a fascinating divergence as we witness gold's continued march toward historic highs while silver quietly builds the foundation for what could be its next major move. This market dynamic creates compelling opportunities for investors weighing the stability of gold against silver's potential for explosive growth.

Gold Price (XAU) at Historic Levels

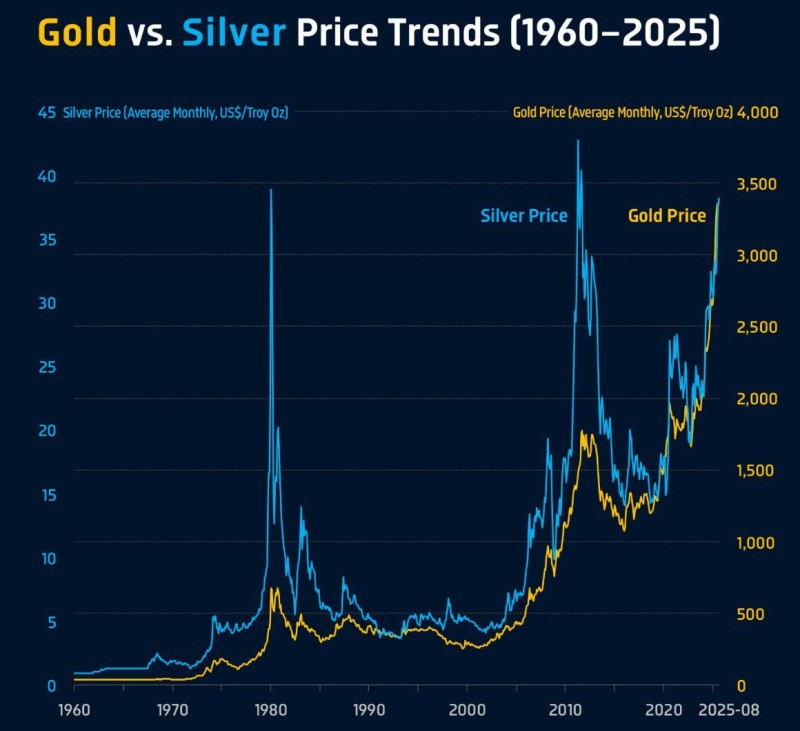

Gold's journey to $3,500 per ounce represents decades of steady appreciation punctuated by dramatic surges during times of crisis. The metal hit significant peaks in the late 1970s and 2011, with another major rally following the post-2020 inflationary environment. Today's price levels confirm gold's enduring appeal as the world's premier safe-haven asset.

Several factors continue driving gold's momentum. Central banks worldwide are increasing their gold reserves, inflation concerns persist despite policy interventions, and ongoing geopolitical tensions create sustained demand for assets that hold value during uncertain times.

Silver Price (XAG) and Insights from @Solix_Trade

Silver tells a different story. Trading between $35-$40 per ounce, it hasn't matched gold's spectacular performance but may be positioning for its own breakout moment. Market analyst @Solix_Trade suggests silver is emerging from years of consolidation and could see significant acceleration once investor sentiment shifts.

History shows that silver typically follows gold's lead but often delivers more dramatic percentage gains when it does move. The metal benefits from strong industrial demand, particularly from the renewable energy sector, battery manufacturing, and electric vehicle production - factors that could amplify any upcoming rally.

Gold vs. Silver: Investor Choices

This divergence presents investors with two distinct paths. Gold offers proven stability and wealth preservation, making it ideal for those seeking protection against monetary instability and inflation. Silver, meanwhile, provides higher growth potential thanks to its unique position as both a precious metal and critical industrial commodity.

The choice between near-record gold and consolidating silver ultimately depends on risk tolerance and investment goals. As market volatility increases and new investment vehicles emerge, both metals could see heightened activity that creates opportunities for traders willing to navigate the inherent risks of precious metals investing.

Usman Salis

Usman Salis

Usman Salis

Usman Salis