While raw materials grab headlines, it's the hidden world of mineral refining where real power lies. The U.S. is learning this lesson the hard way as China's dominance in processing critical minerals exposes vulnerabilities across everything from electronics to energy infrastructure. Now, after decades of decline, American policymakers and industry leaders are racing to bring refining capacity back home.

Why Processing Matters More Than Mining for Silver

The numbers tell a stark story. China mines only about 13% of the world's silver, yet the country controls roughly 70% of refined silver supply. This gap reveals an uncomfortable truth: owning the mine means little if someone else owns the refinery. For XAG and other critical minerals, processing capacity has become the real strategic chokepoint.

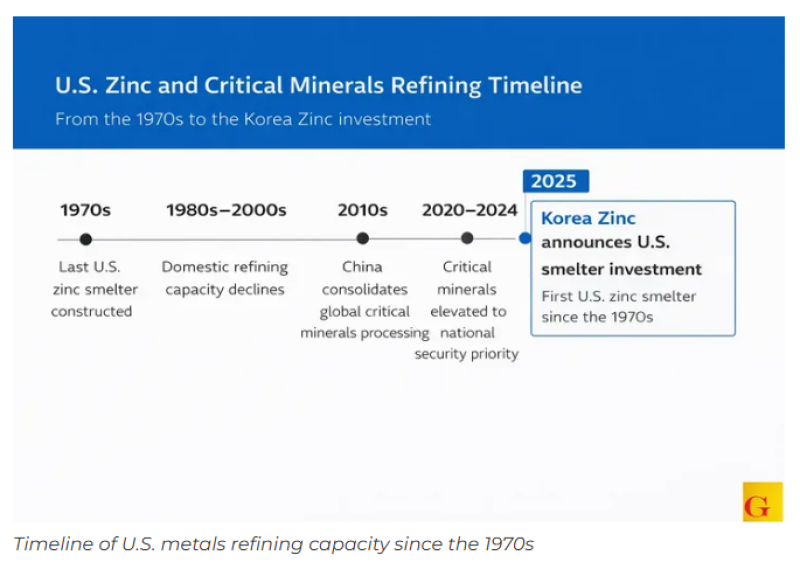

America's refining infrastructure has been crumbling for decades. The last U.S. zinc smelter went up in the 1970s, and domestic capacity kept shrinking until 2025 when Korea Zinc's announcement of a new facility marked the first zinc smelter built in the U.S. in over fifty years.

Critical Minerals Demand Set to Explode Through 2040

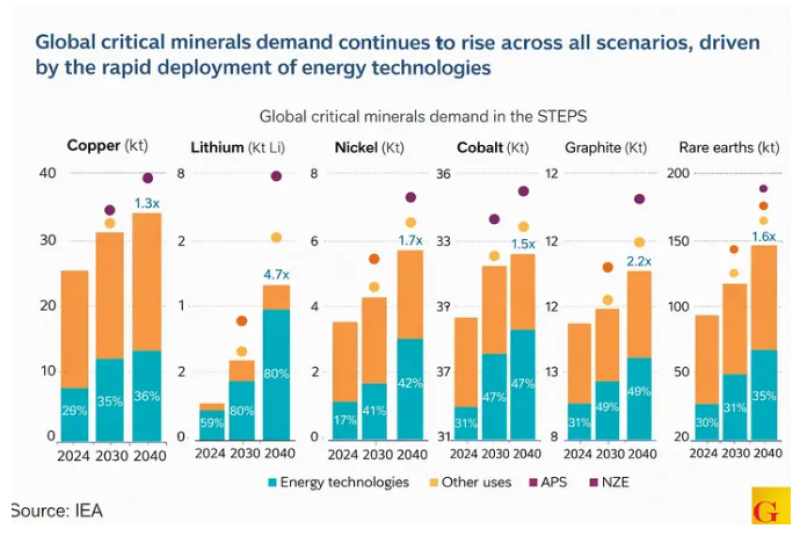

The urgency isn't just about past decline. IEA projections show demand for critical minerals is about to surge. By 2040, lithium needs could jump 4.7 times current levels, graphite 2.2 times, and nickel 1.7 times. Copper, cobalt, and rare earths all face similar multipliers as energy technologies scale up worldwide. Every one of these materials needs refining before it becomes useful, and right now most of that refining happens in one country.

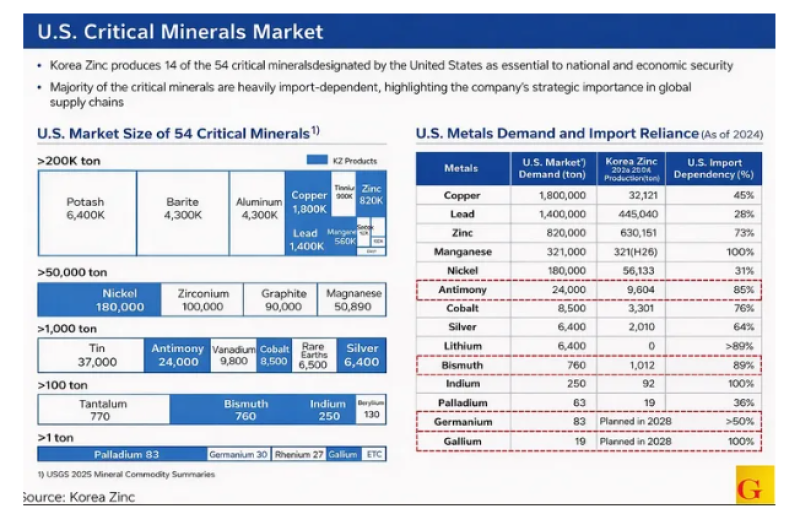

America's Dangerous Import Dependency

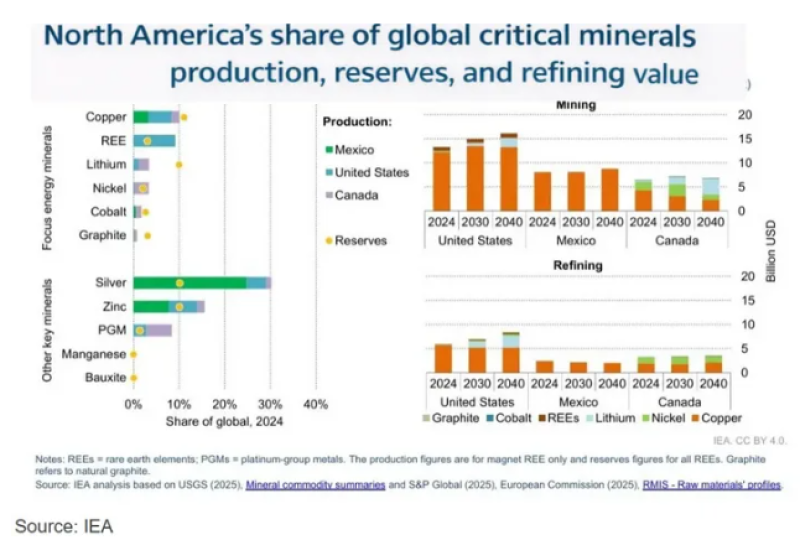

U.S. import numbers paint an uncomfortable picture. The country relies on foreign sources for 100% of its indium and gallium, 89% of lithium, 85% of antimony, 76% of cobalt, and 64% of silver. For silver, this dependency isn't just an economic issue but a supply-chain vulnerability touching advanced electronics, energy systems, and specialized industrial applications.

The bottleneck has shifted from extraction to conversion. Raw ore sitting in the ground doesn't power factories or build solar panels. Refined materials do, and whoever controls refining capacity controls industrial momentum. That's why the current US investment rush into critical mineral supply chains focuses heavily on processing infrastructure rather than just opening new mines.

Rebuilding domestic refining won't happen overnight, but the strategic imperative is clear: in modern manufacturing, the refinery is the real fortress.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova