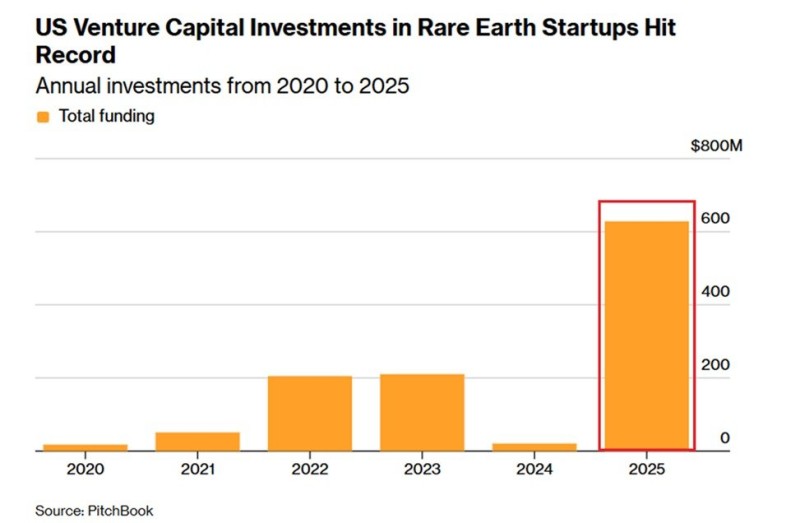

⬤ American venture capital firms just made their biggest bet ever on rare earth startups, pumping a record $628.5 million into the sector in 2025. That's not just a new high—it's a complete game-changer compared to previous years when funding barely registered on the radar.

⬤ Looking at the numbers from 2020 to 2025, the pattern is striking. Funding stayed relatively quiet in the early years, picked up a bit in 2022 and 2023, then crashed hard in 2024. But 2025? It exploded with a nearly 3,000% year-over-year surge that left every previous year in the dust.

⬤ What's driving this rush? Rare earth elements are absolutely essential for everything from smartphones and electric vehicles to wind turbines and military tech. Investors are finally waking up to the reality that relying on concentrated supply sources is a massive risk, and they're backing startups working on exploration, processing, and building out independent supply chains.

⬤ This funding explosion could completely reshape the rare earth industry. More capital means faster innovation, expanded production capacity, and potentially a whole new competitive landscape. The $628.5 million pouring into the sector in 2025 shows that venture capital can pivot incredibly fast when strategic priorities shift—and right now, securing critical mineral supplies is at the top of that list.

Peter Smith

Peter Smith

Peter Smith

Peter Smith