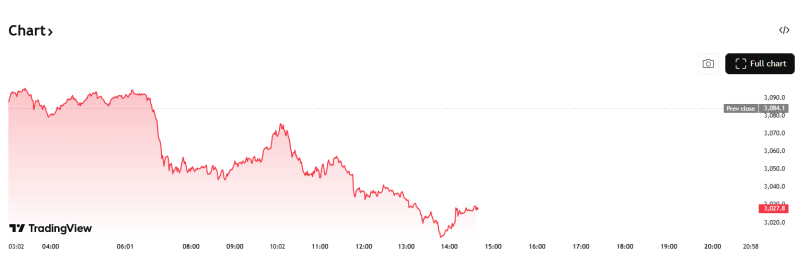

⬤ President Trump is preparing to pull back on some of his 2025 steel and aluminum tariffs as rising costs put pressure on American businesses and consumers. According to a Financial Times report, the administration is reviewing products currently hit with 50% levies, planning exemptions for specific items, and hitting pause on adding anything new to the tariff lists. Markets are reading this as a bullish signal.

⬤ Instead of scrapping tariffs entirely, the approach focuses on carving out exemptions where price pressures hurt most. Since steel and aluminum touch nearly every corner of manufacturing—from cars to appliances—even targeted relief can shift expectations around production costs and pricing. Similar market jitters around trade policy played out when SPY, Dow Drop 1% as Trump Announces 10% EU Tariffs Starting February 1.

⬤ The pause on expanding tariff coverage suggests the administration is stepping back from further escalation while reviewing what's already in place. Specific products will get exemptions, though details on which ones remain unclear. The move comes as retaliatory measures pile up globally, including when Canada Imposes Metal (CN) Tariffs on $21 Billion in U.S. Imports in Retaliation.

As CryptosRus noted, Tariff policy directly impacts market sentiment by shaping cost expectations and supply chain stability across industrial sectors.

⬤ This matters because tariff adjustments don't just affect steel mills and aluminum producers—they ripple through manufacturing, construction, and consumer goods. If exemptions meaningfully reduce the effective tariff burden, markets could see it as easing pressure on industrial activity and inflation. The real test comes when the administration confirms which products get relief and how quickly those changes roll out. Until then, traders will be watching for implementation details that could either validate the bullish read or disappoint expectations.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah