⬤ Major US indices tumbled following fresh tariff announcements targeting the European Union. SPY, the Dow Jones, and Nasdaq 100 all moved decisively lower as Trump outlined a two-stage tariff plan that's got traders nervous about escalating trade tensions. The selling pressure spread across all three benchmarks, with tech stocks getting hit hardest.

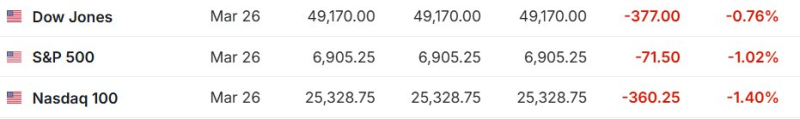

⬤ The numbers tell the story of a risk-off day. The Dow Jones dropped 377 points (0.76%), while the S&P 500 shed 71.5 points, down 1.02%. The Nasdaq 100 took the biggest hit, sliding 1.40% as growth stocks bore the brunt of the selloff. These moves mark a clear shift in sentiment as trade policy uncertainty creeps back into the equation.

⬤ Here's the tariff timeline that's making markets jittery: a 10% tariff kicks in on February 1, with a possible jump to 25% by June 1 if no deal gets done. The announcement came at a particularly sensitive moment—Trump is reportedly eyeing tariff escalation before the Supreme Court weighs in on his previous tariff actions. That timing adds another layer of uncertainty to an already complicated picture.

⬤ This matters because trade risk is back on the radar as a real market mover. When you've got major indices already reacting to every macro headline, throwing tariff threats into the mix can shake up sentiment fast. It disrupts expectations around global trade flows and puts a damper on risk appetite. Political developments are proving they're still a major force in driving market behavior as we push deeper into 2025.

Usman Salis

Usman Salis

Usman Salis

Usman Salis