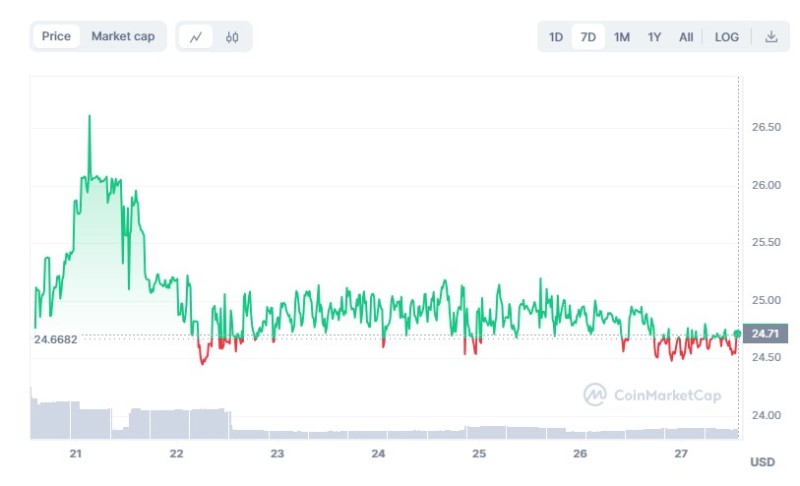

Despite a 1% decline to below $24.71, silver's potential remains promising, with analysts forecasting a surge to $36 amidst favorable market conditions.

XAG Resilience Below $24.66

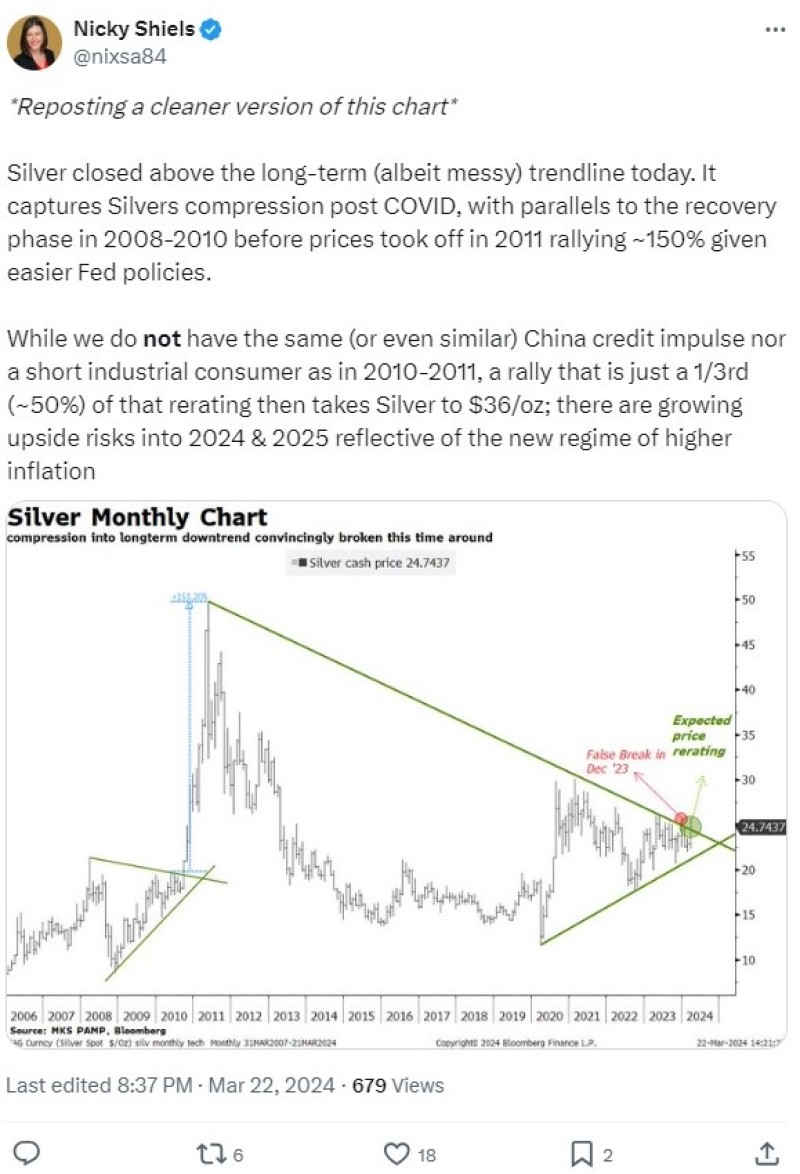

XAG, while trailing behind gold, retains analysts' optimism even as it struggles to maintain gains above $25 per ounce. Nicky Shiels, head of metals strategy at MKS PAMP, highlights silver's resilience, noting a solid floor above $24.71 an ounce and projecting a potential surge to $36 this year.

XAU Support and XAG Lagging Performance

While gold maintains robust support above $2,191 per ounce, silver faces challenges, trading at a one-week low of $24.71 per ounce, down over 1% for the day. The XAU/XAG ratio remains elevated, surpassing 89 points, yet analysts anticipate a reversal fueled by persistent inflation and expected shifts in monetary policy.

Inflation Outlook and XAG Prospects

Shiels anticipates a shift in the XAU/XAG ratio as inflation persists, with the US economy exceeding expectations and global growth stabilizing. The Federal Reserve's indication of potential interest rate cuts amid elevated inflation further bolsters expectations for silver's outperformance.

Despite recent price fluctuations, silver's demand-supply dynamics remain robust. Strong industrial demand, particularly from India, coupled with dwindling production from top producers like Mexico and Peru, drive the market towards another deficit year, with global demand projected to reach 1.2 billion ounces in 2024.

Investment Potential Amidst Market Uncertainty

Shiels emphasizes potential investment demand as central banks consider interest rate cuts, anticipating a bullish trajectory for silver, especially amidst geopolitical uncertainties preceding the US elections. With silver poised to break the $25 mark, momentum-driven investor engagement could further amplify its rally.

Conclusion

Despite current price setbacks, XAG's underlying fundamentals, coupled with favorable market conditions and anticipated shifts in monetary policy, signal a potential rally toward $36 per ounce. As investors navigate market uncertainties, silver emerges as a compelling asset poised for significant upside potential.

Usman Salis

Usman Salis

Usman Salis

Usman Salis