Silver (XAG) is cooling off today after hitting its highest levels since way back in 2012, and honestly? It was about time. The shiny metal's hanging around $36.00 right now as traders cash in their profits from this crazy run-up.

Silver (XAG) Gets Hit by Reality Check After US-China Trade News

So here's what's been going down with silver – it's been on this absolutely insane tear, hitting multi-year highs earlier this week before reality finally kicked in. Right now it's chilling around that $36.00 level, which is pretty important psychologically since it just touched its strongest price since February 2012. That's over a decade ago, people!

The whole thing got started because of some pretty big news on the trade front. Tuesday saw these high-level talks between the US and China wrap up in London, and they actually managed to hammer out what they're calling a "provisional framework agreement." That's got everyone thinking maybe these two countries can stop being at each other's throats all the time.

Trump was pretty pumped about it, saying "We've made real progress with China. It's about fairness, and we're close to something that could work for both countries. I won't sign anything weak." Meanwhile, the Chinese Vice Premier He Lifeng kept it classy but positive, basically saying both sides need to work toward "stable and long-term trade and economic ties."

Here's the thing though – all this good vibes stuff initially sent silver (XAG) higher because when the US and China play nice, it usually means more industrial activity, and silver gets used in tons of industrial applications. But silver was already pretty stretched after its recent rocket ship ride, so even good news couldn't keep pushing it up forever. Sometimes the market just needs to take a breather, you know?

Silver (XAG) Charts Are Screaming "Overbought" Right Now

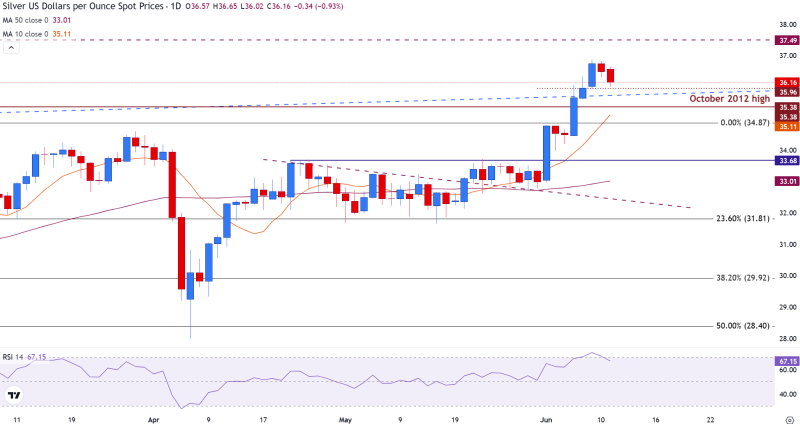

Let's dive into what the technical picture is telling us, because it's actually pretty straightforward. Silver managed to bust through that key resistance at the October 2012 high of $35.96, which was a huge deal. But then it hit a wall around $36.65 and couldn't keep the momentum going, forming what looks like a short-term top just under $37.49.

That $37.49 level is basically the next big mountain silver (XAG) needs to climb if it wants to keep this party going. For now, the first line of defense is that 10-day Simple Moving Average sitting at $35.12. If that breaks, we're looking at the $35.00–$34.87 area, which is where silver previously broke out and also lines up with some important Fibonacci levels.

If things really go south, the next stops would be $34.00 and then the 50-day SMA at $33.01. But if silver wants to get back into beast mode, it's gonna have to convincingly break above that $37.49 resistance we mentioned earlier.

The technical indicators are also flashing some warning signs. The RSI is sitting at 67, which is getting pretty close to that overbought zone where things tend to get dicey. It's basically the market's way of saying "whoa there, cowboy, we might be getting a little ahead of ourselves here."

What's Next for Silver (XAG)? Don't Count It Out Just Yet

So what's the deal with silver (XAG) moving forward? It's honestly a bit of a mixed bag right now. On the positive side, you've got legitimate progress happening with US-China trade talks, which should be fantastic for industrial metals like silver since better trade relations typically mean more manufacturing and industrial demand.

But here's the reality check – silver prices had gotten pretty frothy after hitting those multi-year highs, and traders are clearly in "take profits and run" mode right now. When you've got an RSI pushing 67 and prices that have gone parabolic this quickly, it's totally normal to see some consolidation or even a modest pullback.

The million-dollar question is whether this current dip is just healthy profit-taking after an epic run, or if it's signaling something more serious. Given that the fundamental story with trade talks is still looking good, and industrial demand for silver should get a nice boost from any improvement in US-China relations, this pullback might actually be setting up a sweet entry point for anyone who missed the initial rocket ship.

For now, silver (XAG) traders should probably keep their eyes glued to those key technical levels. If it can hold above $35.12, the bullish story stays alive and kicking. But if it breaks below $34.87, this correction might have some more room to run before finding its footing.

Either way, with all the trade momentum and silver's role in industrial applications, this probably isn't the end of the story for the white metal. Sometimes the best moves come after everyone's had a chance to catch their breath, and that might be exactly what's happening here.

Peter Smith

Peter Smith

Peter Smith

Peter Smith