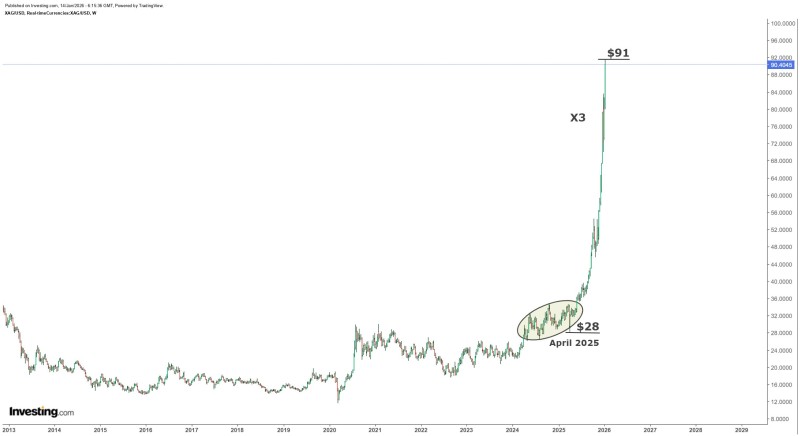

⬤ Silver just delivered one of its most explosive runs in recent history, rocketing from around $28 in early April 2025 to above $90 by early 2026. The weekly chart shows how silver locked into a tight range throughout April 2025 before launching into a steep climb. XAG/USD has now more than tripled in less than a year, marking a fundamental shift in the metal's long-term price structure.

⬤ The chart tells the story of a multi-year setup finally paying off. From 2013 through most of 2024, silver bounced around in a wide but relatively flat range under $30. During that time, price gradually carved out higher lows—classic accumulation behavior. By early 2025, silver compressed into a clearly marked consolidation zone near $28, which turned out to be the launchpad for the explosive move that followed.

⬤ Once silver broke out from that April 2025 base, it didn't look back. The chart shows an almost vertical ascent with barely any meaningful pullbacks. XAG/USD tore through resistance level after resistance level, eventually pushing toward $91. That 3X gain happened with minimal consolidation along the way, suggesting genuine directional conviction rather than choppy volatility.

⬤ This move isn't just about silver—it's a textbook example of how extended compression phases can unleash massive directional trends. Silver's surge to decade highs puts precious metals back in the spotlight and signals shifting long-term dynamics across the sector. With XAG/USD now trading well beyond its historical range, traders are watching closely to see whether the metal consolidates these gains or if the trend still has legs.

Usman Salis

Usman Salis

Usman Salis

Usman Salis