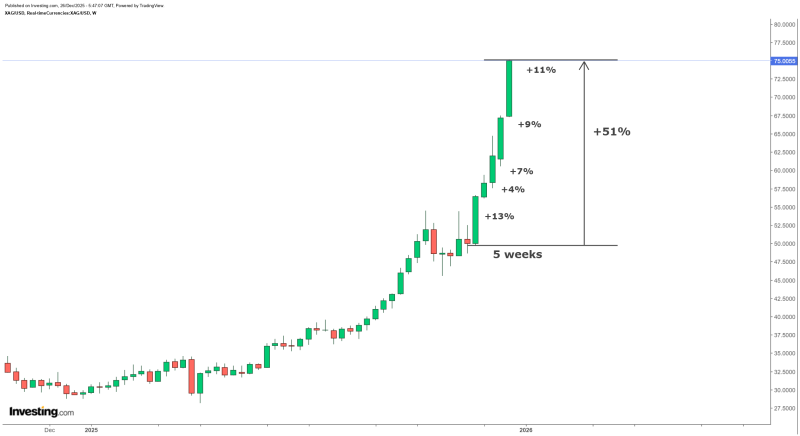

⬤ Silver has powered through a remarkable five-week rally, climbing about 51% to reach the $75 zone. The most recent week alone added around 11% to the metal's value, showing that momentum remains strong despite the already significant gains. While the $11 weekly move looks impressive in dollar terms, it's actually in line with the percentage gains we've been seeing throughout this uptrend.

⬤ The rally has unfolded in stages, with weekly percentage gains running at roughly 13%, 4%, 7%, 9%, and most recently 11%. This step-by-step climb pushed silver from earlier consolidation levels into the mid-$70s, where it briefly tested $75. What's notable here is that despite the sharp rise, the proportional gains suggest the market is moving higher in an orderly fashion rather than showing signs it's running out of steam.

⬤ This surge has taken silver well beyond the consolidation zones it was stuck in during previous months. The consistent percentage gains each week suggest there could still be room for this trend to run further before hitting a major top. The 51% gain compressed into just five weeks is unusual even for silver, which tends to be more volatile than gold.

⬤ A sustained rally at these levels can shift sentiment across the entire precious metals complex and affect how traders position themselves in commodity markets. With silver now trading near the historically significant $75 area, the key questions are whether momentum can continue, if we'll see consolidation next, and how underlying demand for the metal develops as this trend matures.

Peter Smith

Peter Smith

Peter Smith

Peter Smith