The precious metals market is witnessing a pivotal moment as Silver (XAG) approaches what could be the most significant breakout in decades. After years of sideways movement and consolidation, technical analysis reveals a compelling story that has traders and investors reconsidering their positions in this undervalued asset.

Silver Price Forms Decades-Long Cup & Handle Pattern

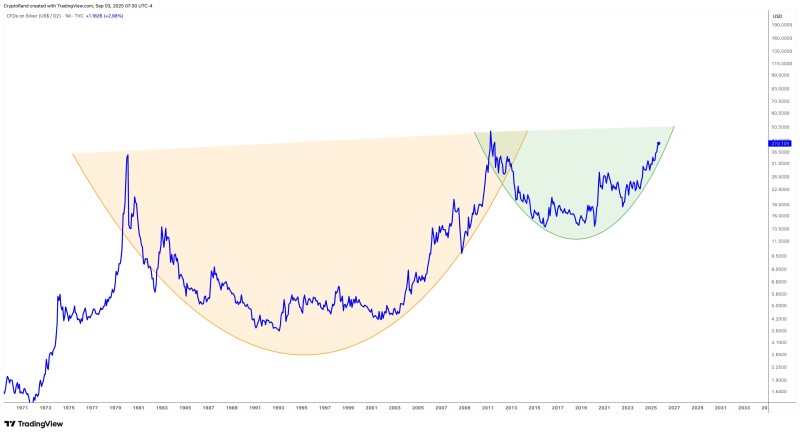

Silver is currently sitting at a crossroads that's been decades in the making. The XAG/USD chart shows an enormous Cup & Handle formation stretching back to the early 1980s - a pattern that technical analysts consider one of the most reliable indicators of major price movements ahead.

Trading around $36.50 per ounce at current levels, silver is testing waters it hasn't seen since 2012. Trader @crypto_rand, who first brought attention to this setup, stated "once you see this massive $XAG Cup & Handle pattern... there is no way back." This suggests we might be looking at the early stages of a multi-year bull cycle rather than just another short-term rally.

The key resistance zone sits between $40-$50, and a clean break above this level could validate the entire pattern, potentially triggering the kind of explosive move that commodity supercycles are known for.

Technical Factors Supporting the Bullish Case

Several technical elements are aligning to support this bullish outlook. The Cup & Handle pattern itself represents decades of price discovery and consolidation, creating a solid foundation for sustained upward movement.

The pattern's massive scale suggests that any resulting move could be proportionally significant. Historical precedent shows that when silver breaks out of long-term consolidation patterns, the moves tend to be swift and substantial, often catching markets off guard.

Volume patterns and momentum indicators are also beginning to show signs of accumulation, suggesting that smart money may already be positioning for the anticipated breakout.

Fundamental Drivers Behind Silver's Potential Rally

Beyond the technical picture, several fundamental factors could fuel silver's ascent. Industrial demand continues to grow, particularly from the renewable energy sector where silver plays a crucial role in solar panel production and battery technology.

Inflationary pressures and currency debasement concerns are driving investors toward precious metals as portfolio hedges. Silver, historically more volatile than gold, tends to outperform during precious metals rallies, offering potentially higher returns for those willing to accept the additional risk.

Supply constraints and mining challenges add another layer of support, as new silver production struggles to keep pace with growing industrial and investment demand.

Market Implications and Price Targets

If this pattern reaches completion, the implications could be far-reaching. A sustained move above the $50 level - silver's previous all-time high - could open the door to price targets that seem almost unthinkable at current levels.

The sheer size of this Cup & Handle formation suggests that the resulting move could dwarf previous silver rallies. Some analysts are already discussing scenarios where silver could reach triple digits, though such predictions should be viewed with appropriate caution.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah