XAG/USD sees mild losses as it retreats from a three-year high to trade around $27.25, influenced by speculations on Fed interest rate cuts.

Speculation on Fed Rate Cuts

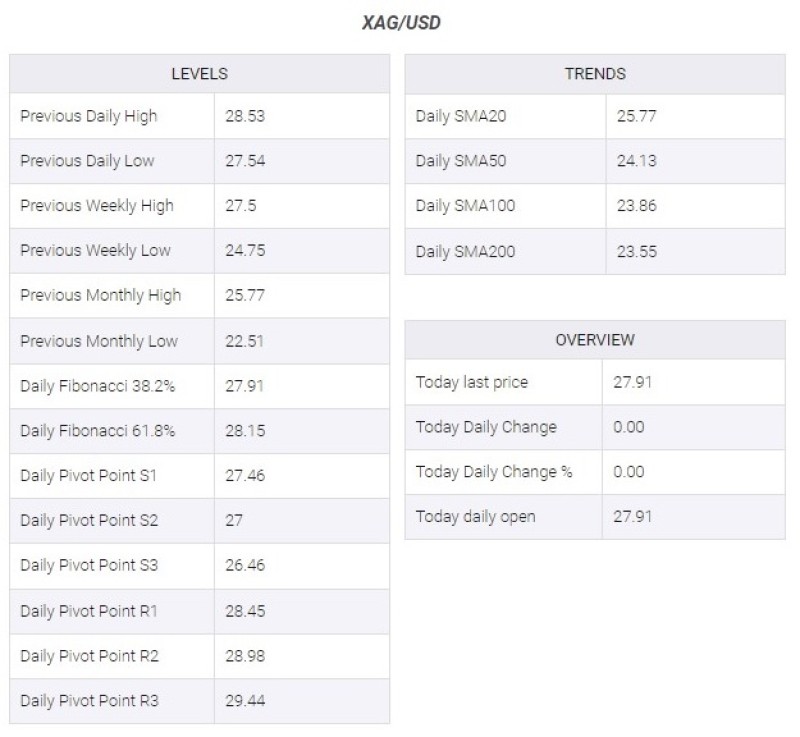

Silver (XAG/USD) retreats from its recent three-year high of $28.53 amid speculation that the Federal Reserve (Fed) may not cut interest rates in June, dragging the metal lower. Traders adjusted their expectations after US inflation surpassed forecasts and President Joe Biden acknowledged the need for further action against rising prices.

The Price Index (CPI) report for March indicated a turbulent path for inflation, leading to a shift in expectations regarding Fed policy. With the possibility of a delay in rate cuts, silver's appeal as an alternative to interest-bearing assets diminishes, constraining its upward momentum.

Market Reaction and Expectations

Traders responded to the CPI data by pushing back expectations for the first rate cut from June to September, as reflected in the CME FedWatch Tool. This adjustment reflects a belief that the Fed will maintain a stance favoring higher interest rates for a prolonged period, which could limit silver's upside potential.

Despite concerns about interest rates, silver finds support from rising industrial demand and its role as an alternative hedge against inflation. This factor may help mitigate the downward pressure on prices, providing a buffer against significant declines.

Geopolitical Tensions' Influence

Geopolitical tensions in the Middle East contribute to XAG appeal as a hedge against inflation. The ongoing conflicts, including the rejection of ceasefire talks between Israel and Hamas, coupled with Iran's vow of retaliation for an airstrike on its embassy in Syria, add to market uncertainty and could lift silver prices in the short term.

Investors are closely monitoring the US March Producer Price Index (PPI) for further market direction. Fresh data could provide additional impetus for silver prices, shaping investor sentiment amid ongoing economic and geopolitical developments.

Conclusion

While XAG faces downward pressure due to speculation surrounding Fed interest rate cuts, factors such as industrial demand and geopolitical tensions offer potential support. The market remains sensitive to economic data and geopolitical events, which could influence silver's trajectory in the coming sessions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis