Silver is once again on traders' radar as July kicks off with renewed momentum. Following a brief holiday pause, bulls are eyeing a key breakout zone that could propel silver prices to fresh highs. A technical setup spotted points to a critical turning point, with potential ripple effects across gold, mining stocks, and broader commodities.

Silver Price Approaches Critical Resistance at $38.50

Silver Futures (XAG/USD) are drawing bullish attention as the metal consolidates near a key resistance zone. The turning point for silver has arrived just after the Independence Day holiday.

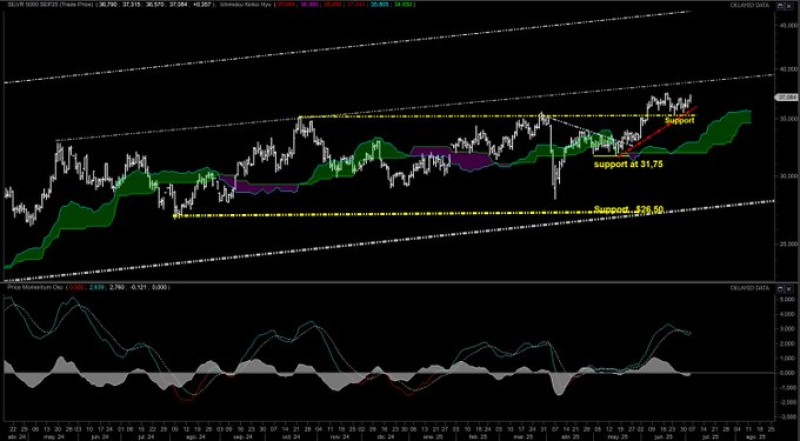

The chart shows Silver Futures trading at $37.08, with visible support levels at $31.75 and $26.50. Technical indicators also point toward sustained bullish momentum, with the Ichimoku cloud providing a supportive base and price action trending inside a rising channel.

Breakout Could Trigger Rally Toward All-Time Highs

A decisive move above the $38.50 resistance could signal a breakout, paving the way for new highs. The trader notes that this resistance might be breached and later retested before the next major move.

If silver clears this hurdle, the upside target may extend toward uncharted territory. The bullish setup in silver is also expected to positively impact gold and mining stocks, which began gaining traction last week.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah