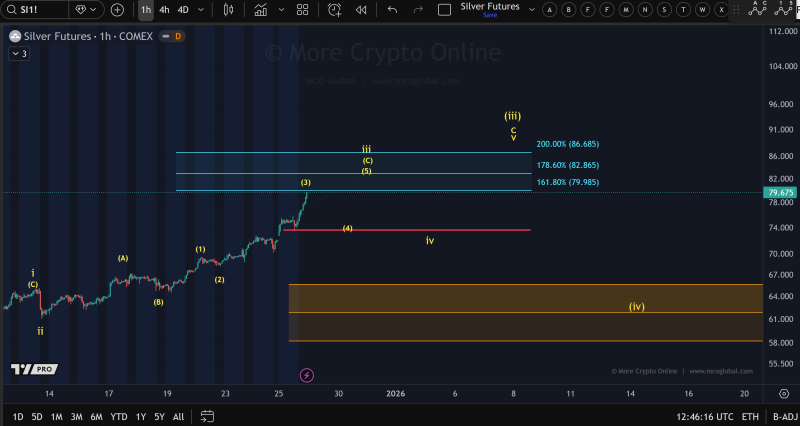

⬤ Silver Futures on COMEX have been pushing higher, with XAG/USD recently hovering around $79.70 as it approaches the psychologically significant $80 threshold. Technical charts are showing an extended rally structure with Fibonacci extension zones mapped out above current prices. Market observers note that silver "might break above 80 soon," though they're also warning that poor risk management tends to get punished even in optimistic market conditions.

⬤ Chart analysis reveals projected Fibonacci extension levels starting near $79.98, followed by additional upside targets around $82.86 and $86.69. These zones represent possible exhaustion points within the current wave pattern. Meanwhile, support structures from earlier price action sit in the mid-$70s range, with deeper retracement support appearing in the low-to-mid $60s. The Elliott Wave framework suggests XAG/USD is working through a final wave sequence, placing current prices right at the upper edge of the highlighted breakout zone.

⬤ Throughout December, XAG/USD has maintained a steady climb that's picked up steam heading into year-end. The technical roadmap indicates that as long as near-term support levels hold, those upside targets remain viable. Still, the potential for volatility exists even within this bullish setup, which is why experienced traders are emphasizing the importance of risk discipline alongside trend-following strategies.

⬤ This move matters because silver functions as both an industrial metal and a hedge asset, meaning significant price advances can ripple through broader metals markets. As Silver Futures test the $80 area, how prices react here could shape trading expectations for the weeks ahead—especially as market participants navigate the balance between riding momentum and managing exposure during periods of heightened optimism.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah