Something interesting happened in precious metals this week. While gold took a hit from macro pressures, silver went the opposite direction - climbing higher and showing real strength.

The Numbers Don't Lie

It's not often you see these two metals move in different directions, but that's exactly what The Old Pretender and other traders have been watching unfold.

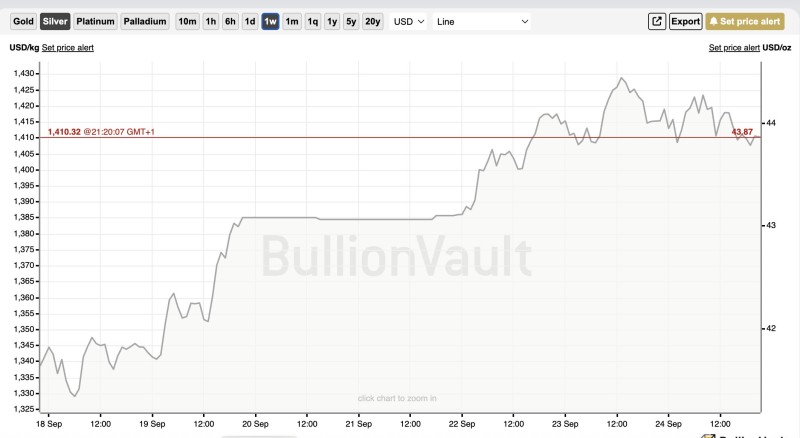

Silver jumped from $1,325/kg on September 18th to $1,410/kg by September 24th, with some intraday action pushing it past $1,425/kg. Meanwhile, gold was heading south over the same stretch. That's a pretty dramatic divergence for metals that usually move together.

What's Behind Silver's Strength

- Industrial demand is real: Silver isn't just a shiny investment - it's crucial for electronics and solar panels, giving it staying power beyond safe-haven buying

- Value play: Silver's been cheap compared to gold for a while, and smart money might be catching on

- Capital rotation: Some speculators could be dumping gold for silver, chasing the relative strength

Silver's proving it's more than just gold's little brother. With industrial applications keeping demand steady and the metal looking undervalued, this strength above $1,410/kg might have legs. If industrial demand stays hot and the value story holds, silver could keep outrunning gold for a while.

Peter Smith

Peter Smith

Peter Smith

Peter Smith