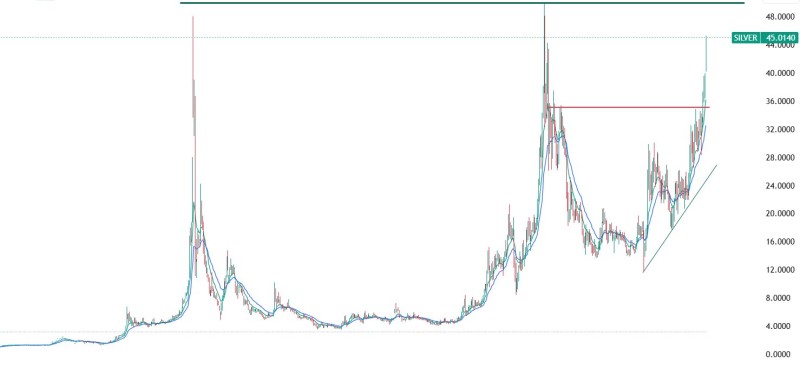

Silver is having its moment. Trading around $45 per ounce, the precious metal is creeping toward what could be the most important level in years - the $48 neckline that's been capping gains and frustrating bulls.

The Technical Setup

Trader Ashish Raj flagged this setup, and it's hard to ignore. We're talking about a potential completion of a massive multi-year pattern that's been building since the $20 lows.

The chart tells a compelling story. Silver smashed through $36 earlier this year, riding a steady uptrend that's been building momentum for months. Now it's knocking on the door of $48 - the make-or-break level that could determine whether this rally has real legs or runs out of steam.

The pattern looks textbook. We've got strong support holding at $40 and $36, creating a solid foundation underneath. But it's that $48 resistance that matters most. Break above it with conviction, and we're looking at a completely different game. Fail here, and silver could easily slide back to test those lower levels again.

Why Silver is Surging

This isn't just technical momentum driving the move. The fundamentals are stacking up nicely too. Inflation concerns are bringing precious metals back into focus as investors hunt for hedges. Industrial demand keeps growing thanks to solar panels, electric vehicles, and all the tech gadgets that can't function without silver. Add in a weakening dollar and geopolitical jitters pushing people toward safe havens, and you've got a recipe for sustained demand.

Here's what really matters for the next move:

- Critical Resistance: $48 - The neckline everyone's watching. Break this with volume and $55-$60 comes into play

- Support Floors: $40 and $36 - These levels have held before and should catch any pullbacks

- Breakout Targets: $55-$60 - Where silver could head if the neckline gives way

Silver is at a crossroads. A clean break above $48 could trigger the kind of move that shifts the entire precious metals landscape. But if it fails here, we're probably looking at another test of support and more sideways action. Either way, this level will likely define silver's path for months to come.

Usman Salis

Usman Salis

Usman Salis

Usman Salis