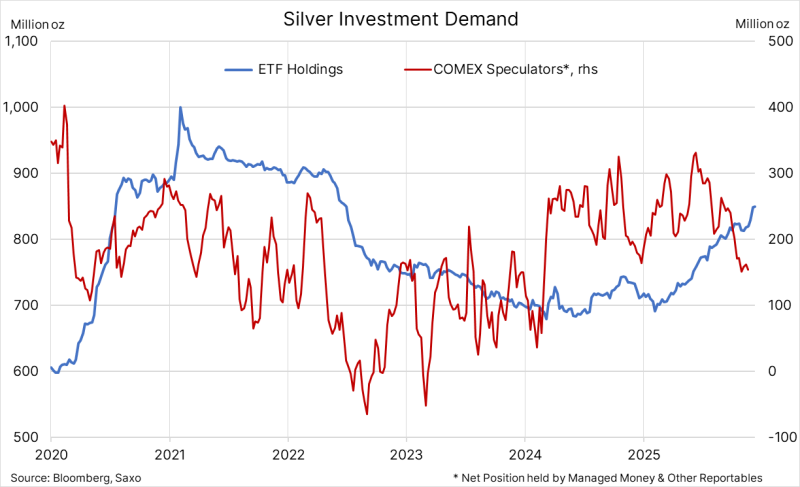

⬤ Silver investment demand has gained speed recently - yet the source is unexpected - exchange traded funds, not futures desks. Exchange-traded funds now hold about 850 million troy ounces, the largest amount recorded in forty two months. The rise equals nineteen per cent since January. Holdings began to recover in late 2023 after a steep slide that started in 2022 and lasted into the first quarter of 2023.

⬤ The futures side presents the opposite picture. According to the Commitments of Traders report dated 25 November, managed money operators plus other large reportables on the COMEX now hold their smallest net long posture in eighteen months - only thirty one thousand contracts, equal to roughly one hundred fifty five million ounces. Charts show that speculative length has dropped well below historical norms.

⬤ The contrast exposes the true source of current demand. Buyers of silver exchange traded funds usually plan to hold for years - they watch inflation, real yields and portfolio balance. Futures operators respond to price swings and short-term openings - at present they show little appetite for risk.

⬤ This division is important for price support. The exchange-traded-fund segment supplies a durable base because the capital stays put and does not flee on the first sign of weakness. With speculators sidelined, there is little leverage fuelled cash to whip prices around. In short the latest strength rests on bona fide investment buying rather than on momentum chasing hot money, a condition that will influence how silver trades during the next multiple months.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova