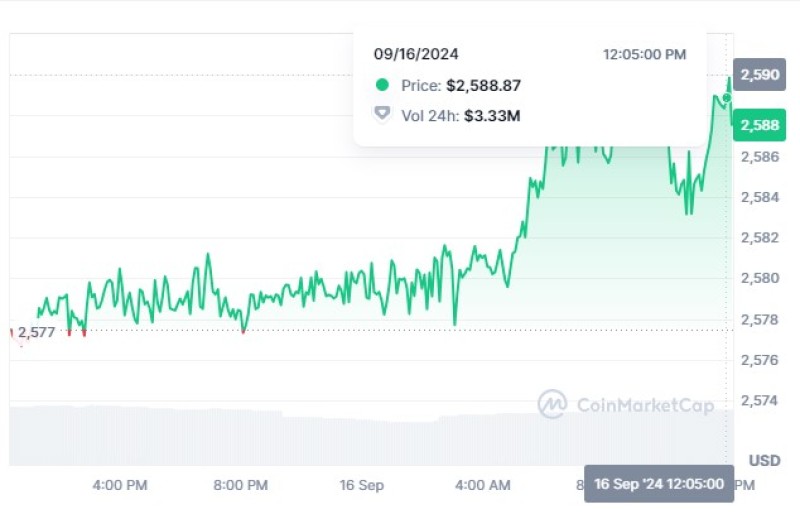

Gold (XAU/USD) surged to an all-time high of $2,590 as traders anticipated a significant rate cut by the Federal Reserve, which could further boost the precious metal’s value.

XAU Reaches Record $2,590

Gold hit a fresh record high on Monday, surpassing the $2,590 per ounce mark as traders rushed to position themselves ahead of a key event—the Federal Reserve’s upcoming interest rate decision. The rise in gold prices was driven by growing expectations that the central bank may implement a substantial interest rate cut, potentially by 50 basis points (bps).

This surge represents a continuation of gold’s strong upward trend, as the precious metal has gained increasing investor interest amidst economic uncertainty and weakening U.S. dollar valuations.

Fed Rate Decision Boosts XAU/USD Rally

The possibility of a 50bps rate cut, which would bring rates down from 5.5% to 5%, has sparked enthusiasm among gold investors. A smaller 25bps cut remains on the table, but market participants seem to favor the more aggressive reduction, which could provide further support to gold’s bullish momentum.

The Federal Reserve’s decision, whether to start with a more cautious quarter-point cut or dive into a half-point reduction, will likely have significant implications for the price of gold in the near term. Traders are advised to review their portfolios and prepare for potential market volatility.

XAU Benefits from Weaker US Dollar

The decline of the U.S. dollar, particularly against the Japanese yen, has also supported gold’s rise. On Monday, the USD/JPY pair dropped to a new 2024 low of ¥140.10. As the U.S. dollar weakens, the appeal of holding non-yielding assets like gold increases, making XAU/USD more attractive to investors.

Gold is often favored in a lower interest rate environment, as it becomes more competitive compared to interest-bearing assets. With the Fed potentially signaling a shift in monetary policy, the outlook for XAU/USD remains positive.

Conclusion

Looking ahead, the gold market is poised to remain highly sensitive to any news related to the Fed’s rate decision. If the central bank delivers a substantial cut, gold prices could continue to rise. On the other hand, a smaller rate reduction might temper some of the current bullish sentiment but still offer long-term support for the precious metal.

Investors will closely monitor not only the Fed’s rate announcement but also any further declines in the U.S. dollar that could drive additional gains in XAU/USD.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah