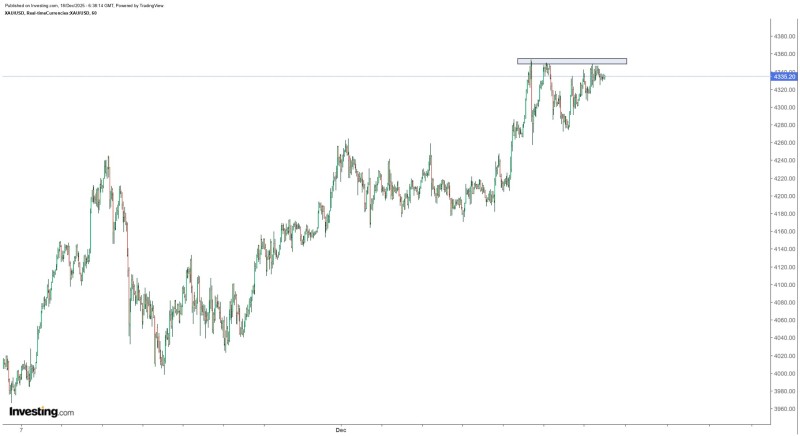

⬤ Gold has been grinding sideways for over a week after rallying hard in early December, with XAU now capped just below the $2,630–$2,640 zone. The price keeps hitting the same ceiling and backing off, creating a tight range instead of pushing through. Even with silver catching a bid, gold hasn't been able to follow through.

⬤ The chart shows higher lows stacking up since late November, which keeps the overall picture bullish even though momentum has cooled. Support is holding, and sellers haven't taken control—this looks more like a breather than a reversal. The market is digesting gains, with volatility dropping as traders wait for the next move.

⬤ Silver's recent strength hasn't helped gold break out, and mining stocks aren't confirming the move either. That's adding some caution to the setup. Gold buyers are still around, but they're not willing to chase price higher without seeing more conviction from the broader metals complex.

⬤ This consolidation matters because gold often leads the way for commodity sentiment and macro trades. If support holds, it could signal strength building for another leg up. But if momentum keeps fading, we might see a deeper pullback. With silver already running and gold stuck in neutral, the next break will likely set the tone for precious metals heading into year-end.

Usman Salis

Usman Salis

Usman Salis

Usman Salis