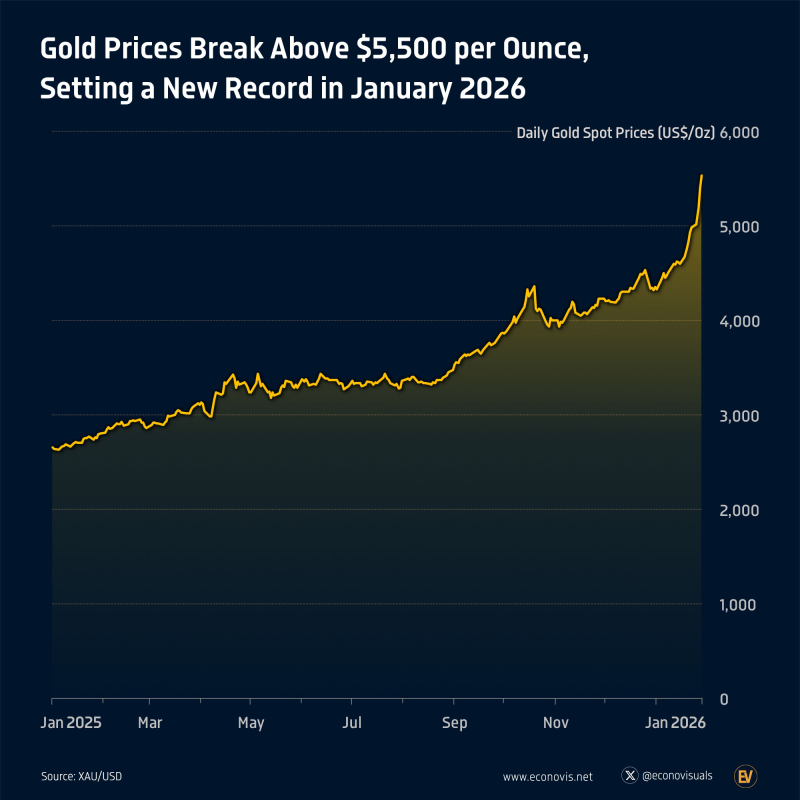

⬤ Gold hit a major milestone when spot prices broke above $5,500 per ounce on January 29, 2026, marking a new all-time high. The breakout caps off a powerful rally that's been building throughout 2025 and gaining speed into early 2026. Daily price charts show gold climbing steadily over the past year before shooting higher at the month's end.

⬤ The numbers tell the story — gold is up roughly 28 percent year to date, an impressive gain just four weeks into the calendar year. Prices have more than doubled from where they traded in 2024. After moving in a broad upward channel during the first half of 2025, gold really picked up steam in the second half, pushing decisively above $4,000 and never looking back.

⬤ Throughout 2025, pullbacks stayed relatively shallow, with the trend forming higher lows as it progressed. Momentum really kicked in during the final months, driving gold past $5,000 and straight through $5,500.

⬤ This rally matters for the broader market because gold's record performance signals a major shift in long-term pricing dynamics. Gains of this size can ripple through commodities and currency markets, with gold often serving as a key reference point. Breaking above $5,500 reinforces gold's role as a major benchmark in global markets and offers insight into broader macro trends as 2026 gets underway.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi