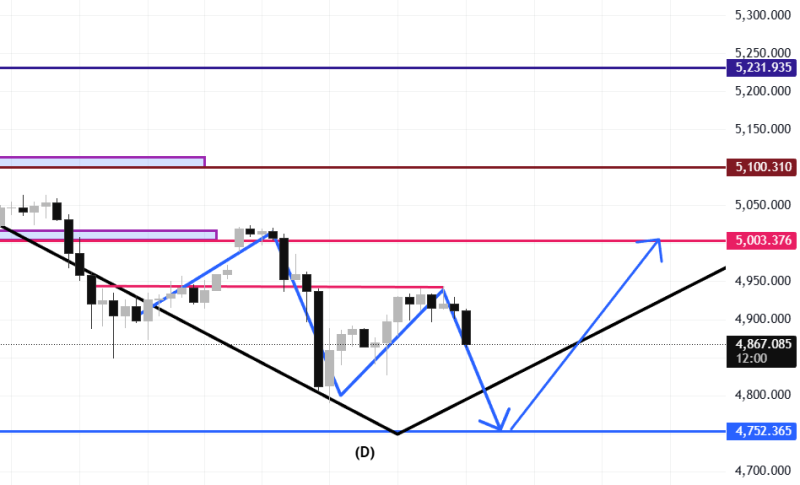

⬤ Gold prices reversed after testing a critical resistance zone near 4940. The pullback brought XAU/USD down to approximately 4860, marking a clear rejection from the upper boundary. The chart shows sellers defending the resistance band and pushing price into a corrective phase within the established range.

⬤ The rejection near 4940 continues a pattern where advances stall around the 5000 region. After failing to hold above 4900, gold stabilized around the 4860 midpoint. This behavior indicates the market is trading between resistance at 4940–5000 and lower support zones, rather than building momentum for a breakout.

⬤ Traders are now monitoring downside targets at 4820 and the broader 4800–4750 support area. This zone represents the projected lower boundary where buyers may step in to defend price. The 4750–4800 range is viewed as a stronger demand area where the market could find stabilization if the correction extends further.

⬤ How gold responds around these support levels will shape the near-term direction. Holding above 4750 would keep the consolidation structure intact, while a breakdown could trigger increased volatility and a deeper correction. The battle between 4940 resistance and 4750 support remains the critical framework for gold's next move.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov