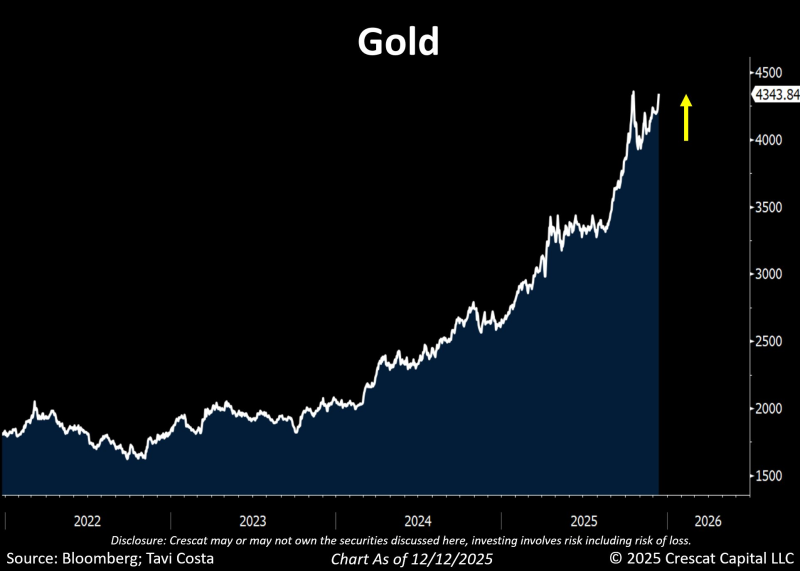

⬤ Gold is making another run at historic highs, with spot prices pushing above $4,300 as of December 12, 2025. The metal has been on a powerful upward trajectory, rising from under $2,000 in 2022 to current levels above $4,300, according to Bloomberg data. This sustained rally shows few signs of slowing, with limited pullbacks along the way.

⬤ The surge comes as the Federal Reserve has clearly moved away from aggressive rate hikes, adopting a more accommodative stance. This shift in monetary policy has created a favorable environment for gold, which typically performs well when central banks ease their grip on interest rates. Recent Fed messaging and policy actions point to growing concern about weakening labor market conditions, adding fuel to gold's momentum.

The metal's renewed strength comes as macroeconomic pressures intensify and monetary policy expectations shift.

⬤ What's interesting is that gold keeps climbing even as many expect inflation to cool down. The metal's persistent strength suggests investors see inflation risks differently than official forecasts indicate. Gold is essentially telling its own story about the economy—one that includes continued uncertainty around growth, employment, and where monetary policy goes from here.

⬤ For markets, gold's push toward record territory matters because it acts as a real-time gauge of confidence in central bank policy and economic stability. When gold rallies this hard, it signals heightened sensitivity to inflation risks and labor market weakness. As these economic pressures remain elevated, gold's advance reinforces its status as a critical indicator of where the global financial system might be headed.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi