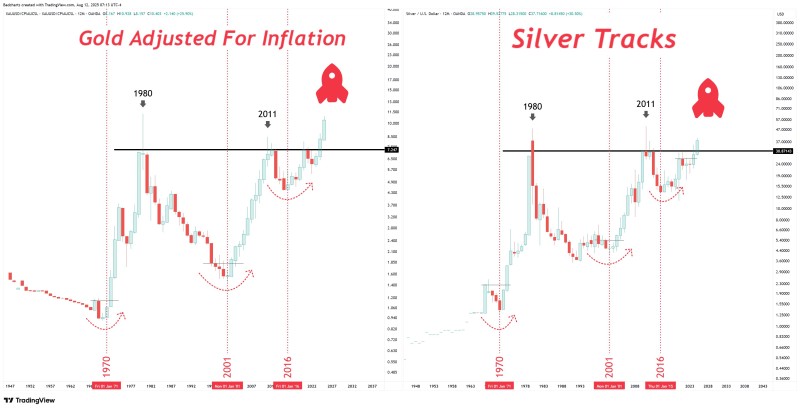

The precious metals world is buzzing with excitement as a technical pattern emerges that's rarer than a solar eclipse. Gold has already punched through its inflation-adjusted resistance at $7,247 – a level that's held firm for decades. Meanwhile, silver is dancing around the $30.87 mark, teasing investors with the possibility of its own explosive breakout.

This isn't just another technical chart pattern. It's the kind of setup that precious metals veterans dream about, appearing only twice since the 1970s. Both previous occurrences – in 1980 and 2011 – unleashed powerful multi-year rallies that rewarded patient investors handsomely.

Gold (XAU) Price Breaks Free from Decades of Resistance

Gold's recent surge above the inflation-adjusted $7,247 resistance level represents more than just a number on a chart. It's the breaking of chains that have bound the yellow metal for generations. When adjusted for inflation, gold's current breakout mirrors the explosive moves that preceded the legendary bull markets of 1980 and 2011.

The fundamentals backing this technical breakthrough are rock-solid. Central banks worldwide continue their gold-buying spree, geopolitical tensions refuse to cool down, and inflation keeps rearing its ugly head despite central bankers' best efforts. This perfect storm of factors suggests gold's momentum isn't just a flash in the pan.

Silver (XAG) Price Poised for Its Moment

Silver has always been gold's more volatile younger sibling, and right now it's sitting pretty at a crucial juncture. The $30.87 resistance level isn't just another price point – it's a gateway that's historically opened the floodgates for massive silver rallies.

If silver manages to close 2025 above this critical threshold, it could trigger one of the most spectacular precious metals rallies in decades. The metal's industrial demand, combined with its monetary properties, creates a unique dynamic that often results in percentage gains that dwarf even gold's impressive moves.

Why This Time Could Be Different

The current macroeconomic backdrop reads like a precious metals investor's wish list. Stubborn inflation refuses to retreat to central bank targets, global debt levels have reached eye-watering heights, and investors are scrambling for safe-haven assets that can preserve wealth through uncertain times.

This rare technical alignment between gold and silver, combined with today's economic environment, has analysts calling it one of the most compelling long-term opportunities in the precious metals sector. History doesn't repeat, but it sure does rhyme – and right now, it's humming a very familiar tune.

Peter Smith

Peter Smith

Peter Smith

Peter Smith