Gold's impressive rally continues to gain steam, and according to Deutsche Bank, we're just getting started. The investment bank projects gold could average $4,000 per ounce by 2026, while silver targets $45 per ounce. This isn't just another bullish call—it reflects a fundamental shift happening in global markets where central banks are buying aggressively, the Fed is shifting course, and supply constraints are tightening across precious metals.

Gold's Bullish Momentum Builds

Deutsche Bank's analysts see several powerful forces converging to push gold significantly higher. The forecast, recently highlighted by market watchers, comes as more investors view gold not just as a crisis hedge but as a core portfolio holding. This represents more than typical price appreciation—it suggests gold is being revalued within the broader financial system as geopolitical tensions rise and monetary policies shift worldwide.

Technical Picture Supports the Rally

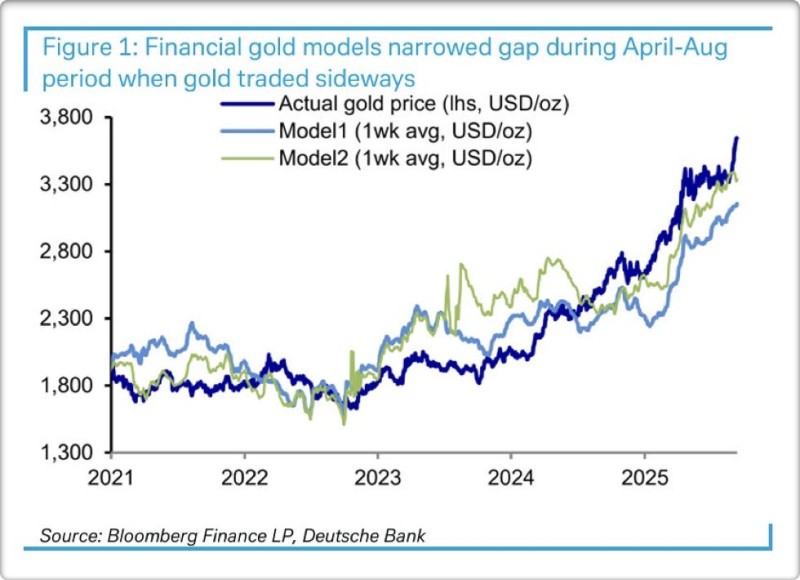

Looking at gold's chart, the bullish case is clearly visible. Gold has climbed from around $1,800 in 2021 to above $3,700 by mid-2025, showing remarkable strength. After consolidating sideways between April and August while financial models caught up with actual prices, gold broke out decisively and surged past key resistance levels. The price action now closely tracks model projections, with the trajectory pointing directly toward that $4,000 target. This classic consolidation-breakout pattern, combined with strong model alignment, gives the forecast significant technical credibility.

Key Drivers Behind the $4,000 Target

Several structural forces are working together to support higher gold prices:

- Central bank buying continues: Countries are diversifying reserves away from the dollar, creating sustained institutional demand

- Fed policy shift: Expected rate cuts reduce the opportunity cost of holding non-yielding assets like gold

- Dollar weakness: A declining USD makes gold more attractive to international buyers

- Silver supply deficit: Tight physical markets and growing industrial demand support the entire precious metals complex

Silver's Supporting Role

Silver's forecast of $45/oz by 2026 makes perfect sense given its dual nature as both a monetary metal and industrial commodity. With surging demand from solar panels, electronics, and electric vehicles, silver often outperforms gold during late-cycle commodity rallies, and current supply constraints only add to the bullish picture.

Usman Salis

Usman Salis

Usman Salis

Usman Salis