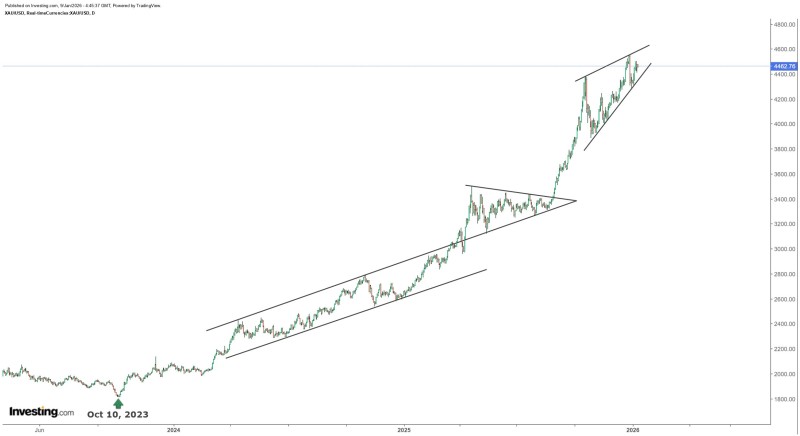

⬤ Gold's been climbing steadily since early October 2023, and the XAU daily chart makes it pretty clear this isn't just some random spike. Price has been respecting rising trendlines for over two years now, showing this is a proper sustained move rather than a flash-in-the-pan rally.

⬤ The current bull cycle kicked off on October 10, 2023. Throughout 2024, gold pushed higher inside a broad ascending channel, with each dip finding support near the lower trendline before bouncing back up. These consolidations weren't messy—they were clean, orderly pauses that added fuel for the next leg higher.

⬤ In 2025, things got interesting. Gold went sideways for a bit, forming a tighter consolidation pattern before breaking into a steeper upward channel. That's when prices really accelerated, climbing from the low $3,000s all the way into the mid-$4,000 range. Right now, XAU is trading near the top of this rising structure with some volatility, but the main trendlines are still holding strong.

⬤ Why does this matter? Gold tends to reflect what big money is thinking about the macro picture. When you see this kind of persistent, structured climb with controlled pullbacks, it signals real demand—not just speculative froth. As long as XAU keeps respecting these established trendlines, it's telling us something important about market confidence, macro stability, and how investors view hard assets in the current financial environment.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir