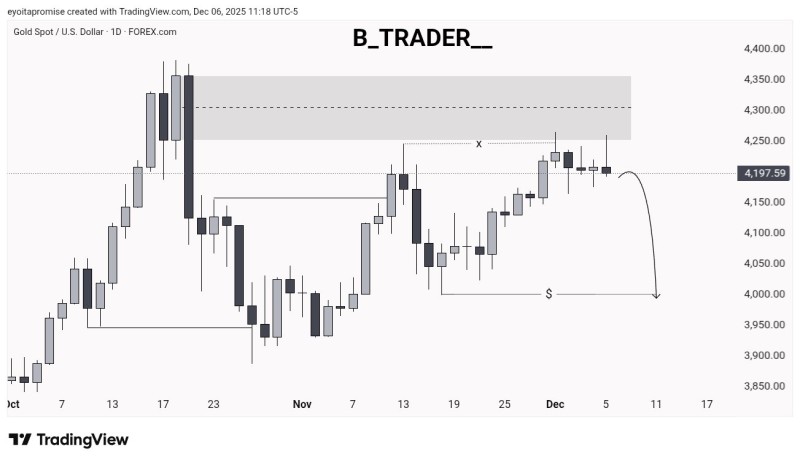

⬤ Gold couldn't push past its recent highs this week, getting stuck below a clearly marked supply zone on the daily chart. XAU/USD kept bumping into resistance and eventually started pulling back, closing near $4,197. Bulls tried several times to break higher but couldn't get it done, and now the momentum seems to be shifting.

⬤ The supply zone sits between $4,250 and $4,330, and every time price approached that area, it got rejected. That ceiling has held firm through multiple tests, creating a pattern that shows buyers are losing steam. After failing to punch through, gold started consolidating, and that sideways movement has now tilted bearish.

⬤ The chart shows how price stalled right under that resistance level before turning back down. This behavior around key liquidity zones isn't new for gold—it tends to react sharply when hitting these supply areas. The latest candles reflect that shift in sentiment, with the market clearly hesitating after the failed breakout attempt.

⬤ If this downward move plays out, a drop to $4,000 would be a significant pullback. That kind of retracement could ripple through the metals market and affect how traders view risk in the near term. With gold unable to clear its supply zone, the next few sessions will show whether sellers take full control or if buyers can step back in and defend higher levels.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah