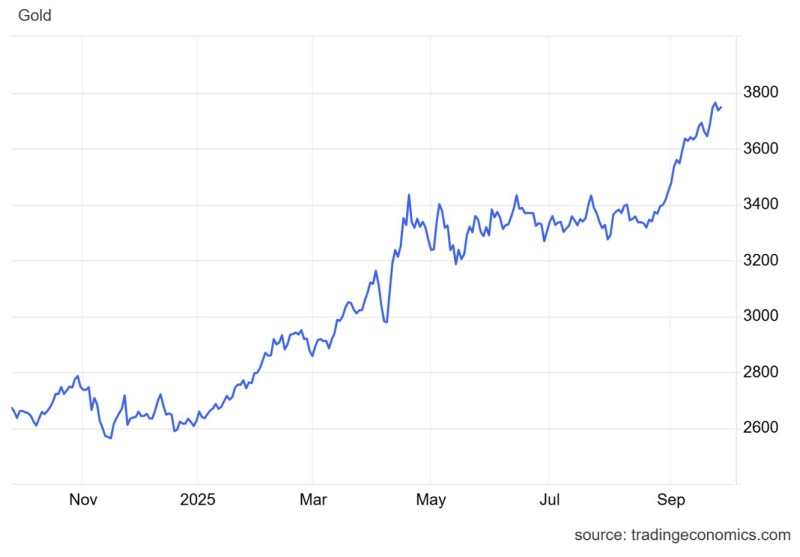

Gold isn't just rallying - it's absolutely demolishing everything else in its path. We're talking about a 42% year-to-date gain that's pushed the metal past $3,780 per ounce, hitting fresh all-time highs. Meanwhile, the S&P 500 managed a modest 13%, the Dow crawled to 9%, and even the tech-heavy NASDAQ could only muster 17%. This isn't just outperformance - it's a statement.

The Numbers Don't Lie

As Stephen Moore pointed out, when gold beats stocks by this kind of margin, it's screaming that investors are genuinely worried about what's coming next.

Looking at the chart, gold's been on an absolute tear, especially in the second half of 2025. While stock investors were celebrating their single-digit and low double-digit gains, gold holders were watching their positions triple those returns. This kind of divergence doesn't happen by accident - it's the market's way of saying that traditional safe havens aren't cutting it anymore.

The surge isn't coming out of nowhere. Inflation might be "cooling" according to official numbers, but investors clearly aren't buying it. They're parking money in gold as insurance against their purchasing power getting destroyed. Central banks are gobbling up gold like there's no tomorrow, especially in emerging markets where they're actively trying to reduce their dollar exposure. Throw in geopolitical tensions that seem to pop up everywhere you look, and you've got the perfect storm for gold demand.

Then there's the dollar situation. Markets are already positioning for potential policy shifts heading into 2026, and a weaker dollar outlook is adding fuel to gold's fire. When the world's reserve currency starts looking shaky, guess where the smart money goes?

Technical Picture and What's Next

From a technical standpoint, gold blasted through the $3,600 resistance level like it wasn't even there. The next major hurdle sits around $3,850-$3,900, and with momentum this strong, that target doesn't look too ambitious.

- Support: $3,600 - The breakout level that's now the floor

- Resistance: $3,850-$3,900 - Where the next battle will be fought

- RSI Warning - Getting a bit overheated, but the trend is still rock solid

Gold's performance is telling us something important about the current market environment. When precious metals are crushing stocks by this margin, it's not just about portfolio diversification anymore - it's about survival. If inflation fears stick around and central banks keep buying, we could be looking at even higher highs as we head into 2026. For anyone still wondering whether gold deserves a spot in their portfolio, this 42% surge just answered that question.

Peter Smith

Peter Smith

Peter Smith

Peter Smith