⬤ Gold shot back up after a brief pullback last Friday, recovering all those losses in surprisingly little time. The selloff didn't do the technical damage traders were bracing for—instead, gold snapped right back to its upward trajectory. That kind of speed tells you there's real buying pressure waiting in the wings every time XAU dips.

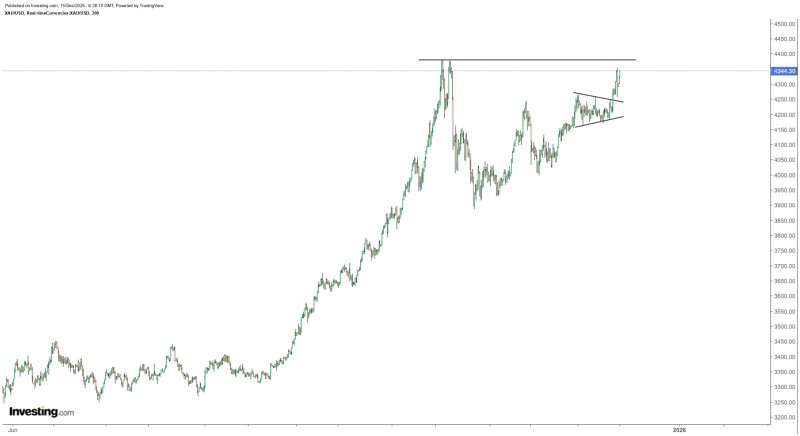

⬤ The chart backs this up completely. Gold's been climbing for months now, breaking out from a mid-year consolidation into a proper rally with consistent higher highs and lows. After hitting a recent top, prices took a breather before pushing up again. The fact that the dip got bought up so fast shows pullbacks are getting absorbed immediately—there's strong demand on any weakness.

⬤ From a technical standpoint, gold's sitting near important resistance while forming what looks like a bullish continuation pattern. The chart shows price compressing in a tighter range before breaking higher—that's usually trend continuation, not reversal. This setup keeps the $4,700 level realistic as a year-end target, assuming momentum holds.

⬤ This matters beyond just gold itself because XAU often reflects bigger shifts in macro positioning, liquidity expectations, and how traders are handling risk. If gold keeps bouncing fast from dips and maintaining upward pressure, it could influence sentiment across commodities and currencies as we head into year-end.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi