With the upcoming release of the Personal Consumption Expenditures Price Index, investors should keep an eye on gold stocks such as Barrick Gold Corp, Royal Gold Inc, and Newmont Corporation.

Inflation Data to Impact XAU Stocks

The Personal Consumption Expenditures Price Index (PCE), the Federal Reserve's preferred inflation gauge, is set to be released later this week. Investors are eagerly awaiting this data for clues on the central bank's interest rate decisions, with many still hoping for a rate cut this year. However, some officials remain cautious due to persistent inflation.

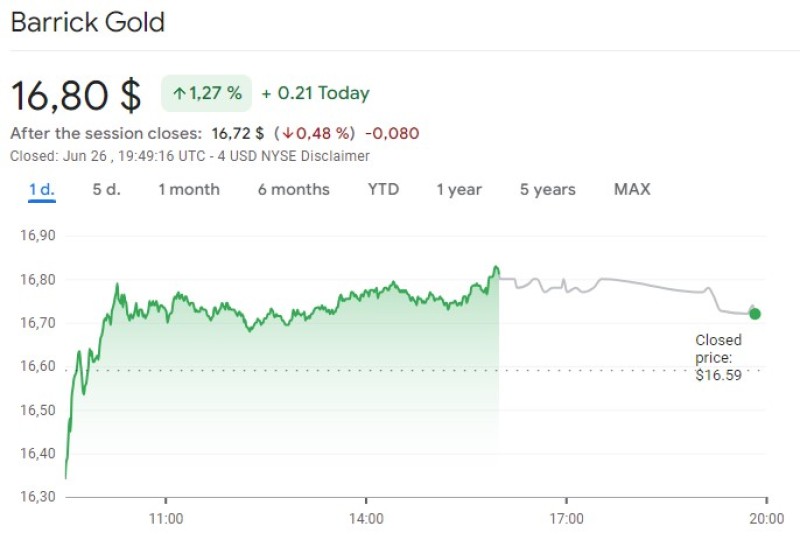

Barrick Gold Corp, trading under the ticker XAU, has seen a slight increase of 0.6%, currently priced at $16.80. The stock recently bounced off long-term support at the $16 level and is not far from its 52-week high of $18.94, achieved on April 12. Despite facing pressure at the $17 mark, GOLD has added 14.2% over the past nine months, showcasing its resilience in a volatile market.

Royal Gold Inc (NASDAQ:RGLD) Tests Resistance

Royal Gold Inc, under the ticker RGLD, is up 1.45% to $124.94. The stock is testing resistance at its 20-day moving average, a level it has struggled with since late May. The $120 level has acted as a floor for RGLD, preventing a deeper pullback from its 52-week high of $134.56 on May 21. Over the past 12 months, Royal Gold has gained 11.1%, though it remains close to breakeven for 2024.

Newmont Corporation, trading as NEM, is down 1.07%, currently at $41.45. The stock has been trading above its 20-day moving average since late March, which is expected to contain today's losses. Earlier this year, NEM hit a six-year low of $29.43 on February 28. The stock has remained flat both year-to-date and over the past 12 months, reflecting the challenges it faces in the current market environment.

Strategic Moves in a Volatile Market

As market conditions fluctuate, having a strategic plan is more crucial than ever. Expert trader Chris Prybal has demonstrated an ability to navigate volatility, identifying significant stock rallies when others might overlook them. His strategies have yielded impressive gains, such as +207% on RTX calls, +236% on MARA calls, and +238% on NET calls.

Prybal suggests that making a few simple moves on Sunday at 7 PM could be the "Secret Sauce" needed for portfolios to not only stay afloat but achieve unprecedented gains in this turbulent market.

Conclusion

As the release of the Personal Consumption Expenditures Price Index approaches, the performance of gold stocks like Barrick Gold Corp, Royal Gold Inc, and Newmont Corporation will be closely watched by investors.

The potential impact of inflation data on interest rate decisions could significantly influence gold prices, making it essential for investors to stay informed and prepared. With strategic insights and careful monitoring, investors can navigate the volatility and make informed decisions to capitalize on market movements. Whether it's the resilience shown by XAU, the resistance testing of RGLD, or the challenges faced by NEM, each stock presents unique opportunities and risks in the current economic landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah