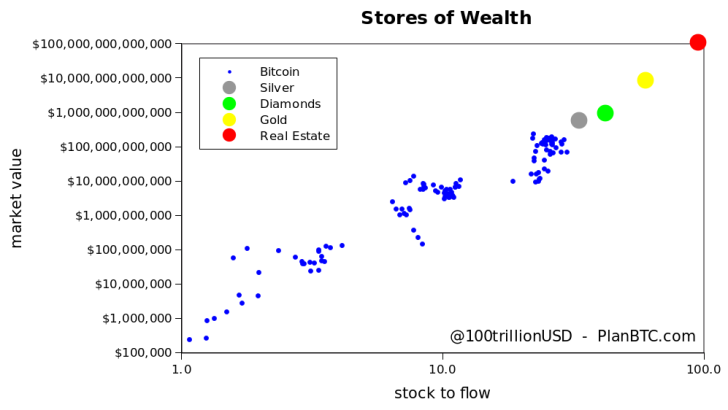

This model treats Bitcoin as things like gold, silver, or platinum. These items are known as "store of value" because their relative rarity means they retain value over a long period of time.

How Are These Assets Similar?

Their production a method of gold prospecting and digging that is expensive and time-consuming-is difficult to raise dramatically. Bitcoin is similar, as it is also scarce. Indeed, the first digital entity that exists is a scarce digital entity.

There are few coins, and mining the remaining 3 million will require a lot of energy and computing work, and so the availability level is constantly low.

Ever-Increasing Complexity

In order to measure the actual inventory of a commodity (total value available currently) and the production of new goods (quantity produced during the given year), the inventory to output ratio will be used.

A high coefficient suggests that products with a stock like gold, platinum or silver are not primarily used in industrial applications. Much of it is held as a cash background, thereby raising the inventory to flow ratio.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov